The following media release was prepared by the Shareholder Association for Research and Education (SHARE) and includes a proposal by Hamilton Community Foundation urging Bank of Nova Scotia (“Scotiabank”) to conduct a third-party racial equity audit as a risk-management practice.

Investors urge Scotiabank to conduct Racial Equity Audit

Bank of Nova Scotia an outlier among Canada’s “Big Six”

TORONTO. March 26, 2025. Investors are urging the Bank of Nova Scotia (TSX:BNS) to catch up with its peers by agreeing to assess both the impacts of its business practices on racialized communities, and the risks to shareholder value those impacts represent.

The request for Scotiabank to conduct a third-party racial equity audit (REA) is contained in a shareholder proposal submitted by SHARE, the Shareholder Association for Research and Education, on behalf of the Hamilton Community Foundation.

Sarah Couturier-Tanoh, Director of Shareholder Advocacy at SHARE, notes that Scotiabank is the lone outlier among Canada’s “Big Six” banks in failing to commit to this crucial risk-management practice.

“Other major Canadian banks — namely BMO, RBC, NBC, and CIBC — have committed to conduct these audits as part of their broader efforts to improve financial inclusion,” said Couturier-Tanoh.

“We are concerned that Scotiabank may fall behind its peers in adapting to emerging regulatory trends and shifting customer demographics.”

The Scotiabank proposal comes at a time of increased pushback against corporate diversity, equity and inclusion (DEI) initiatives in the U.S. During a “market open” event at the Toronto Stock Exchange last week to mark the United Nations International Day for the Elimination of Racial Discrimination, investors noted the need for Canadian companies to reaffirm their commitment to combating racism and inequity.

“Openness to diversity, equity and inclusion is a critical differentiator for Canadian businesses, Canadian capital markets, and Canadian investors — and a critical driver of value within those markets,” Yulena Wan, Chief Operating Officer and Chief Financial Officer of the Hamilton Community Foundation, said during her introductory remarks at the event.

Couturier-Tanoh said it’s imperative for Scotiabank to “step up” at this pivotal moment.

“The current political circumstances demand leadership from banks — not cold feet,” she said.

The shareholder proposal will be voted on at Scotiabank’s annual general meeting (AGM) on April 8.

For media inquiries or interview requests, please contact SHARE Communications Manager Adam Burns at aburns@share.ca

About SHARE

SHARE is an award-winning non-profit organization dedicated to mobilizing investor leadership for a sustainable, inclusive and productive economy. We do this by supporting our investor network and amplifying their voices to improve corporate sustainability practices and implement better rules and regulations that govern capital markets.

For more information on SHARE, visit: www.share.ca

Charles’ governance experience spans five decades. He has chaired many organizations including Sons of Italy (Hamilton & National), Burlington Community Foundation, Villa Italia Retirement Complex, Art Gallery of Hamilton, Hamilton Health Sciences, The Sicilian Cultural Society of Hamilton. Charles was a lawyer from 1985 to 2018 and was also a mediator and arbitrator in commercial law disputes and a construction law adjudicator until the end of 2023.

Charles has received several awards including Italian Canadian Citizen of the Year (2010), Festitalia Heritage Award (2015), CIBPA Professional Excellence Award (2018) and Sicilian Ambassador (2022).

Sandra Ramelli is an accomplished strategist, human resources, and organizational development practitioner with experience in multiple sectors including health care, steel and education. For the past decade Sandra has held several senior roles in health care and has served as a trusted advisor and coach to many administrative and physician leaders. She has extensive experience in strategic planning, leadership and team development, quality improvement, human resources and in leading complex transformational change. As an assistant professor in the Department of Medicine at McMaster University, Sandra supports the growth and development of physicians through the delivery of leadership development programs and coaching. In addition to her professional experience, Sandra is a Certified Health Executive, an ICF certified coach, a certified LEADS® coach and facilitator, and is certified in Kaplan-Norton Balanced Scorecard methodology, She holds a Master of Business Administration from York University Schulich School of Business, a Bachelor of Education from the University of Toronto and an Honours Bachelor of Commerce from McMaster University.

As a newly appointed member of the Board of Directors for the Hamilton Community Foundation, Nazia is passionate about promoting equity and inclusion within our Hamilton community. With over a decade of experience in social services, community development and mental health counseling, she has dedicated her career to advocating for marginalized groups, specializing in providing trauma-informed, person-centered care to diverse populations, including children, youth, and older adults. Thought out her career, Nazia has actively contributed to creating inclusive policies and programs. With a Master of Social Work from Wilfrid Laurier University and fluency in multiple languages, she is dedicated to advancing the foundation’s mission to drive positive change and improve the quality of life in Hamilton.

Melissa Alzaeim brings a wealth of experience and a commitment to community engagement, equity, and strategic leadership to the Board of Directors of Hamilton Community Foundation. With a distinguished career spanning academia, non-profit organizations, the private sector, and international development, Melissa is dedicated to driving positive change and fostering inclusive communities.

Her international experience in research operations and grants management, including roles at McMaster University and Sheridan College, highlights her strategic oversight, financial stewardship, and governance expertise.

An immigrant to Canada with a multicultural background and fluency in multiple languages, Melissa’s engagement with diverse communities aligns with the Foundation’s values of equity and Reconciliation. Her skills in project management, strategic planning, financial management, and community engagement are essential for effective governance.

Committed to upholding integrity, ethical leadership, and accountability, Melissa is dedicated to advancing the Foundation’s goals and contributing to a vibrant, diverse, and inclusive Hamilton.

As founder of Mary J Williams Coaching & Consulting Inc, Mary works with leaders across the country as an executive leadership coach and thinking partner. Mary has more than three decades of experience and leadership in educational and not-for-profit advancement. As McMaster University’s past Vice-President, Advancement, Mary led an award winning team with a mandate that included communications and marketing, government and alumni relations and fundraising. At the University of Toronto, Mary supported more than 30 academic divisions in their activities to work towards the university’s $4 billion campaign fundraising goal. As an active volunteer in her communities, Mary has extensive governance experience and has served on a wide range of non-profit boards locally, provincially and nationally. She is a graduate of three universities and has completed the McMaster Chartered Directors program.

Kevin Tom is the Chief Investment Officer of Hamilton based FirstOntario Credit Union. He has over 25 years of experience within the financial services industry in British Columbia and Ontario. One of his current areas of responsibility includes the alternative investments portfolio, which is active in the affordable housing space, through policy advocacy, development and acquisitions.

Kevin is an advocate for social justice and equality. He is involved in organizations that seek to increase the affordable housing inventory in our communities and currently sits on the board of the Hamilton Centre for Civic Inclusion.

Jason is a born and raised Hamiltonian. An urban planner by profession, Jason led the City of Hamilton’s Planning and Economic Development Department from 2014 to 2024. Currently in private practice as an urban planner, Jason works across the country helping communities of all sizes tackle complex urban challenges. Prior to his career as an urban planner, Jason worked for several years in environmental advocacy, including with local groups such as the Bay Area Restoration Council and Bruce Trail Association. Jason lives in the heart of downtown Hamilton with his partner, where he frequently enjoys experiencing Hamilton’s vibrant arts and entertainment scene.

FINAL REPORTS for 2023-24 grants from the Edith H. Turner Foundation Fund are due DECEMBER 1, 2024. A link to the report form has been emailed to all grantees. If you did not receive this link, please contact Tami Henderson at 905.523.5600 x 241, or t.henderson@hamiltoncommunityfoundation.ca

We are no longer able to accept final reports via email. Your final report MUST be submitted through the online portal. To access this form, you will first need to log into your HCF online account through the portal. The final report form can be found under the ‘Requirements’ tab.

A troubleshooting guide can be found here.

Sarah has been involved with the Hamilton Community Foundation since 2007. She has a long track record of community service and is passionate about giving back and has provided volunteer leadership to a number of local charities, service clubs and philanthropic organizations.

Sarah brings to her role extensive experience as lead Portfolio Manager, Senior Wealth Advisor and head of The Murphy Investment Group at CIBC Wood Gundy. With over 20 years of experience, Sarah values educating and empowering her clients, which include individuals, multi-generational families, charities and large institutions. Sarah was chosen as one of Canada’s Top Wealth Advisors: Best in Province by The Globe and Mail and Shook Research.

Amy Montour is a member of the Six Nations of the Grand River community and brings Two-Eyed Seeing to her role, incorporating her knowledge as an Indigenous person and Western-trained physician to Hamilton Community Foundation’s work.

Amy is currently co-lead for the Division of Indigenous Medicine in the Brant Community Healthcare System and a palliative care physician servicing Six Nations of the Grand River Territory and Haldimand County. Her work focuses on improving the experience of Indigenous people accessing health systems and includes advocacy, education, clinical practice and system innovation.

Cheryl Jensen is the retired president of Algonquin College and also had a long career at Mohawk College, where she held the title of Vice President, Academic. Cheryl first joined Mohawk as a Chemical Engineering Technology professor in 1983 and served as Dean, Executive Dean, and Vice President of Engineering Technology, Apprenticeship and Corporate Training.

Cheryl has served on numerous boards related to education, entrepreneurship, and philanthropy. She is known for her organizational and community leadership which has been recognized with numerous awards in Hamilton, Ottawa and nationally through the Association of Canadian Community Colleges.

Cam Beatty is an accounting and finance professional who is accustomed to advising businesses and not-for-profit organizations, and provides his input and support to HCF through this lens, and with a keen interest in the short- and long-term well-being of the Hamilton community.

Cam has been a Partner of Durward Jones Barkwell & Company LLP (DJB) since 2007 and is the current chair of its executive committee. In this role, Cam helps to set and shape the firm’s strategic direction as well as serving clients in a variety of industries.

Shylo Elmayan has over 15 years of experience working in Indigenous community relations. She is currently the Owner and Lead of Niibin Advisory Services, an Indigenous consulting firm specializing in policy development and community engagement. She was recently the Director of Indigenous Student Services at McMaster University and was responsible for leading a department that supports all aspects of the student experience and success of McMaster’s Indigenous. She had worked previously at McMaster to develop and administer the university’s employment equity census.

Prior joining McMaster, Shylo was a Senior Project Manager with the City of Hamilton and led the development of Hamilton’s first urban Indigenous strategy. Shylo previously worked at Hydro One Networks progressing to Senior Manager, First Nations and Métis Relations. Other previous employment include policy advisor with the Ontario Ministry of Aboriginal Affairs and tenant rights advocate with Aboriginal Legal Services.

Shylo is Anishinaabe and lives in Caledonia. She is a member of the Long Lake #58 First Nation and her family’s traditional territory is located near Hornepayne, Ontario. She has a Bachelor’s degree in First Nations Studies and Political Science from the University of British Columbia and Master’s degree in Public Policy and Administration from Toronto Metropolitan University.

Sandra Edrupt is retired from her role as General Manager Strategy & Business Planning at ArcelorMittal Dofasco and has worked in a variety of management roles in strategy, marketing, quality systems, communications and public affairs, corporate planning and sales.

Sandra is an involved member of the community with extensive governance and other volunteer senior leadership experience with numerous organizations in health care, education, the arts and philanthropy. Recognition for Sandra’s leadership includes distinguished service awards from both the McMaster Alumni Association and McMaster Association of Part-Time Students.

Pranav Pandya is a financial executive with over 20 years of private market and impact investment experience. He is a Principal at Black Hills Advisory Group, providing investment advisory services to institutional investors. Prior to this role, Pranav was the Chief Operating Officer and Chief Financial Officer at a Toronto-based private equity firm specializing in renewable energy, infrastructure, growth equity, and real estate. Pranav is a member of the Chartered Professional Accountants of Ontario.

Haider Saeed is a family physician with the Hamilton Family Health Team and the Shelter Health Network. His broad scope of practice brings him in contact with a wide variety of patients, giving him a window into the challenges and stressors they face.

As a medical editor, Haider has a strong understanding of evidence-based medicine and using data to make decisions. He has a long-term interest in urban geography and advocates for people to live healthier lives within cities.

Elizabeth Gray (Mi’kmaw) was born in New Brunswick and has been an active member of the Hamilton Urban Indigenous Community for over 30 years. She brings over a decade of non-profit board experience to HCF, including serving as a director with Dundas Valley Non-Profit Housing, Sacajawea Non-Profit Housing and De dwa da dehs nye>s Hamilton Aboriginal Health Centre.

Elizabeth holds a BA (McMaster), Master of Social Work (Laurier), an Indigenous Educators Certificate in Indigegogy (Laurier) and a Certificate in Reconciliation, Conflict Prevention and the Promotion of more Inclusive Societies (McGill).

Elizabeth is currently the Indigenous Counsellor for Mohawk College and also volunteers as an advisor for Centre for Community Engaged Narrative Arts, Body Brave, a National Indigenous Advisory Committee for GBV in the Media and the Hamilton Indigenous Consultation Circle. Elizabeth has been named one of Laurier’s Inspiring Indigenous Alumni.

Assad is an award-winning senior leadership professional with over two decades of experience in the architectural, engineering and construction industry. After more than a decade of working in private sector, Assad has held senior positions with the Niagara Parks Commission, Town of Lincoln, Hamilton Public Library and Conservation Halton. As a leader in sustainable projects, Assad loves to create innovative, inclusive, and inspiring places and spaces. As an HCF director, Assad draws from his individual area of expertise in strategic and capital planning to provide sound lived advice.

| CityHousing Hamilton (Sponsor: City of Hamilton) | $21,200 |

| De dwa da dehs nye>s Aboriginal Health Centre | $25,000 |

| Elizabeth Fry Society | $5,000 |

| Essential Aid and Family Services of Ontario Inc. | $10,000 |

| Good Shepherd Centres Hamilton | $25,000 |

| Hamilton Community Legal Clinic | $10,000 |

| Hamilton Downtown Mosque | $20,000 |

| Hamilton East Kiwanis Boys' and Girls' Club | $8,800 |

| Hamilton Foodshare | $20,000 |

| Hamilton Regional Indian Centre | $20,000 |

| HamSMaRT (Hamilton Social Medicine Response Team) (Sponsor: The AIDS Network) | $10,000 |

| Living Rock Ministries | $20,000 |

| Mission Services of Hamilton | $25,000 |

| Muslim Association of Hamilton | $15,000 |

| Neighbour to Neighbour Centre (Hamilton) | $20,000 |

| Refuge (Sponsor: Empowerment Squared) | $15,000 |

| Shelter Health Network (Sponsor: Good Shepherd Centres Hamilton) | $10,000 |

| St. Matthew's House | $10,000 |

| The Salvation Army Hamilton Booth Centre | $25,000 |

| Welcome Inn Community Centre of Hamilton | $15,000 |

| Wesley Urban Ministries | $25,000 |

| YWCA Hamilton | $25,000 |

| Body Brave | Support to meet needs of Hamilton clients unable to access usual hospital supports at this time | $10,500 |

| Big Brothers Big Sisters of Halton Hamilton | Supports staff coverage and volunteer training for program to identify and connect with highly vulnerable children in their programs for weekly well-being check-in and encouragement/engagement | $15,000 |

| Cancer Assistance Program | Support delivery of essentials to clients | $7,500 |

| Catholic Children's Aid Society of Hamilton | Food security for kinship families and children in care, and basic needs for youth aging out of care | $16,000 |

| City Housing Hamilton | Food support for highly vulnerable populations, and support for personal hygiene products | $5,300 |

| Dr. Bob Kemp Hospice | Support PPE and ipads for patients to stay connected to families | $10,000 |

| Elizabeth Fry Society Southern Ontario Region | Essential hygiene, food and childcare needs | $5,000 |

| Elliott Heights Baptist Church | Food support for vulnerable children and families in the Larch After School Program | $5,000 |

| Elliot Heights Baptist Church | Maintain and expand Larch After School program during COVID-19 | $10,000 |

| Empowerment Squared | Support to help newcomer families access government assistance and other resources | $25,000 |

| Eva Rothwell Centre | Food security | $4,000 |

| Good Shepherd Centres | Support for most-needed items including food, diapers, hygiene products, and technology to engage with clients | $25,000 |

| Grenfell Ministries/Welcome Inn Community Centre of Hamilton | Purchase of basic needs and harm reduction supplies for vulnerable people and Overdose Prevention Line and small grants for people just released from corrections | $3,500 |

| Hamilton Centre for Civic Inclusion | Support to Caremongering program, food security prioritizing racialized and disabled people | $15,000 |

| Hamilton Habitat for Humanity | Provide free home repairs for vulnerable homeowners living in unsafe conditions | $10,000 |

| Hamilton Jewish Federation | Food security | $5,000 |

| Hamilton Foundation for Student Success | Support for equitable access to learning in the Hamilton-Wentworth District School Board | $50,000 |

| Hamilton Wentworth Catholic District School Board | Support for equitable access to learning | $30,000 |

| HAMSMaRT/Keeping Six | Support outreach coordinator and peer support worker roles and provide essential supplies for clients | $20,000 |

| Immigrants Working Centre | Technology and computer literacy support for newcomer individuals and families | $7,020 |

| Institute for Advancements in Mental Health | Support to meet needs of Hamilton clients unable to access usual hospital supports at this time | $10,000 |

| Interval House of Hamilton | Support enabling existing staff to focus on COVID-19 related issues and tasks | $4,120 |

| Interval House of Hamilton | Support initiatives to keep women experiencing intimate partner violence safe, connected and comfortable during the pandemic | $6,650 |

| Islamic Relief- IR Canada | Culturally appropriate basic necessities for newcomers/refugees, people with low income and seniors | $15,000 |

| L'Arche Hamilton | Technology to administer proper care remotely, and to prepare isolation spaces | $15,000 |

| Learning Disabilities Association of Halton | Provide supports not covered elsewhere for Hamilton students with learning disabilities and exceptionalities | $5,324 |

| Liberty For Youth | Support ability to provide mentorship, mental health and other services online, and to provide basic needs and other support for vulnerable youth affected by pandemic | $20,000 |

| Micah House Refugee Reception Services Inc. | Support basic needs of tenants in shelter | $5,000 |

| Mohawk College | Purchase basic needs items for packages for international students/families in financial need | $25,000 |

| Neighbour 2 Neighbour Centre | Support food access through gardening for families and individuals living on low-incomes | $14,200 |

| Parkview Church of the Christian and Missionary Alliance | Purchase essential items for food boxes for people in need | $15,000 |

| Refuge: Hamilton Centre for Newcomer Health/Empowerment Squared | Support translation services for Refuge clients | $15,000 |

| Second Harvest Food Support Committee | Expand foodrescue.ca platform to Hamilton, to facilitate donation of surplus food from businesses to social service organizations | $15,000 |

| Sex Workers' Action Program of Hamilton/Hamilton AIDS Network | Support for emergency food, housing, transportation, hygiene items and other small grants related needs arising from COVID-19 | $5,000 |

| Shalom Village | Support staff costs for resident care related to COVID-19 | $24,000 |

| Spinal Cord Injury Ontario | Offset administrative costs related to online platforms for staff, clients, family and caregivers | $6,000 |

| St. Joseph’s Healthcare Foundation | Support Mobile Nursing Clinic to assist outpatients managing mental illness | $50,000 |

| Victorian Order of Nurses - Hamilton | Maintain services and connection to clients and caregivers while day and respite care services are closed | $5,000 |

| Welcome Inn Community Centre | Support to maintain services to multiple vulnerable populations normally supported by thrift store revenues | $25,000 |

| Wellwood Resource Centre | Continuation and expansion of transition to virtual programming, online self-help resources and online peer-mentoring | $10,000 |

| Wesley Urban Ministries | Provide hot meals to vulnerable people in Hamilton | $15,000 |

| YMCA of Hamilton/Burlington/Brantford | Basic needs of tenants in transitional housing | $25,000 |

| Total | $609,114 |

| Afro Canadian Caribbean Association | Offset revenue loss and buying PPE, sanitation supplies and dividers. | $20,000 |

| Afro Canadian Caribbean Association | Create a virtual program where seniors can connect and provide culturally-centred mental health supports | $30,000 |

| Alzheimer Society | Reconfiguring space, cleaning supplies and costs to continue online and in-person programming | $12,300 |

| Ancaster Community Services | Partial recovery of revenue lost from cancelled fundraisers, purchase of PPE, program costs, purchase of a new staff laptop. | $15,000 |

| Big Brothers Big Sisters | PPE, staffing, equipment and covering youth activitiy fees for in-person physical and social program for youth | $15,158 |

| Body Brave | Curriculum development and knowledge translation. | $10,000 |

| City Kidz Ministry | Buying PPE, wages for program delivery, program materials and staff training. | $10,000 |

| Culture for Kids in the Arts | Move resonance choir for children and youth with disabilities online | $15,000 |

| Dundas Valley School of Art | Program equipment and equipment for staff to work remotely. | $10,000 |

| Dundas Valley School of Art | Supplies for online art therapy for frontline workers | $17,100 |

| Dundas Youth Chaplaincy | Offsets revenue loss to allow for continuation of programming. | $10,000 |

| Elliot Heights Baptist Church | Offsets revenue loss to allow for continuation of child/youth programming. | $10,000 |

| Empowerment Squared | Offsets revenue loss to allow an Educational Program Coordinator for racialized newcomer youth to continue. | $10,000 |

| Essential Aid & Family Services of Ontario | Offsets revenue loss to allow for providing essential needs. | $10,000 |

| Friends of the Aviary | Offsets revenue loss to allow vet visits and buying bird food. | $8,000 |

| Hamilton Artists Inc. | Supports efforts to further engage BIPOC artists in an effective way during and post-pandemic. Also supports BIPOC-focused professional development for staff. | $8,000 |

| Hamilton Children's Choir | Online programming and social distancing practices in-person. | $10,000 |

| Hamilton Conservatory for the Arts | To develop new forms of program delivery in the context of the pandemic. | $3,000 |

| Hamilton Jewish Federation | Food, hygiene supplies and transportation expenses related to winter essential kits and kosher food bank support | $11,500 |

| Hamilton Naturalists' Club | Supports GO Explore outdoor education program in schools. | $9,000 |

| Hamilton Philharmonic Orchestra | Moving performances online. | $15,000 |

| Hamilton Theatre Inc | Supports replacement of revenue loss. | $10,000 |

| Hamilton Youth Steel Orchestra | Space rental and equipment for virtual performances. | $20,000 |

| Living Rock Ministries | Supports replacement of revenue loss and buying safety supplies and equipment. | $15,000 |

| Micah House | Materials related to settlement program for new refugees | $18,844 |

| Mohawk College Foundation | Address food security issues related to COVID-19 for Mohawk College Indigenous students/households | $20,000 |

| Native Women's Centre | Supports board members' ability to connect remotely during the pandemic. | $9,081 |

| Neighbour 2 Neighbour | Offsets revenue loss used to fund the emergency food program. | $10,000 |

| Parkview Church of the Christian and Missionary Alliance | Supports replacement of revenue loss. | $10,000 |

| Portugese Community Support | Online programming and preparing physical space and PPE for socially-distanced programing for adults and families with disabilities | $8,517 |

| Refuge (Sponsor: Empowerment Squared) | Outreach worker and program supplies to support mental health of racialized youth | $30,000 |

| Salvation Army | Mobile unit and PPE to allow women on conditional release to safely visit with social supports during pandemic | $14,000 |

| Social Planning & Research Council of Hamilton | Retrofitting of office space. | $2,000 |

| Somali Community in Hamilton | Online programming and safe reopening of offices. | $10,000 |

| Somali Community in Hamilton (Sponsor: Afro Canadian Caribbean Association) | Educational and other resources to reduce and prevent negative health outcomes | $25,000 |

| St. Matthew's House | Moving fundraising online. | $10,000 |

| Student Open Circles | Supports replacement of lost revenue and moving services online. | $14,000 |

| Suicide Prevention Community Council of Hamilton | Supports replacement of revenue loss. | $7,500 |

| The Baby Depot | Rental of additional space in order to serve more families, and buying PPE. | $17,000 |

| The Equestrian Association for the Disabled (T.E.A.D.) | Supports replacement of revenue loss. | $10,000 |

| The SPACE Youth Centre | Safe reopening of offices. | $10,000 |

| Tottering Biped Theatre | Supports replacement of revenue loss | $10,000 |

| Welcome Inn Community Centre | Funding for adapting volunteer supports. | $10,000 |

| Total | $550,000 |

| De dwa da dehs nye>s Aboriginal Health Centre | Indigenous Community Event and Vaccine Education | $28,000 |

| Hamilton Social Medical Response Team (HAMSMaRT) | Expand peer-based harm reduction work in serving street-entrenched and drug user populations | $77,450 |

| The John Howard Society | Cleaning and equipment costs | $25,000 |

| Niwasa Kendaaswin Teg | Poverty reduction worker providing culturally relevant wrap around supports | $62,000 |

| Social Planning and Research Council (SPRC) | Financial empowerment program supporting Hamiltonian’s access to financial benefits to which they are entitled | $75,000 |

| Total | $267,450 |

| A Rocha Canada | Supporting grant | $15,000 |

| ACORN Institute Canada | Helping tenants access their housing rights during COVID-19 | $15,000 |

| Afro-Canadian Caribbean Association | Black Community Wellness Project: providing culturally appropriate mental health services | $46,250 |

| Amity Goodwill Industries | Pandemic community meal relief in support of De Mazanod Door outreach program | $44,850 |

| Art Gallery of Hamilton | Learn - Artist-led projects for children in Grades K-5 | $20,000 |

| Big Brothers Big Sisters of Halton and Hamilton | Systems navigation support for wraparound services | $30,000 |

| Body Brave | Urgent treatment and support for women struggling with COVID-19-triggered mental illness | $20,000 |

| Brott Music Festival | Brott In The Park: Socially distanced concert series | $10,000 |

| Cancer Assistance Program | Supporting drive & ride van program | $15,000 |

| Carnegie Gallery | Programming, equipment upgrade and operating assistance | $12,500 |

| Catholic Youth Organization | Camperships and equipment to allow for social distancing | $27,600 |

| Centre[3] for Print and Media Arts | Arts-based modules for isolated seniors | $15,000 |

| City Housing Hamilton | Prepared meals for seniors | $9,000 |

| Compass Community Health | Pathways Hamilton summer food security and social work services | $56,000 |

| Culture for Kids in the Arts | Support for virtual programming | $16,650 |

| Dr. Bob Kemp Hospice | Advancing health care directives, grieving during COVID-19, equipment and trauma bereavement supports | $30,000 |

| Dundas Valley Orchestra | –Support for providing outdoor, distanced rehearsals and concerts | $6,980 |

| Dundas Valley School of Art | Support for fund development staff | $20,000 |

| Eagles Nest Association of Waterdown | Mental health therapy for children and youth | $10,000 |

| Elizabeth Fry Society Southern Ontario Region | Supporting grant | $10,000 |

| Elliot Heights Baptist Church | LARCH after-school program - hot meal delivery and re-integration supports | $20,000 |

| Factory Media Centre | Digital collaboration software and web design for artists | $5,000 |

| Filipinas of HamOnt (Sponsor: Hamilton Centre for Civic Inclusion) | Organizing Hamilton Asian Alliance | $5,000 |

| Fit Active Beautiful Foundation | FAB Girl and volunteer coach recruitment | $5,000 |

| Flamborough Information & Community Services | Virtual programming to support rural seniors | $15,000 |

| Ghana Association of Hamilton (Sponsor: Church of Pentecost Canada) | Supporting seniors in need through a buddy system | $25,000 |

| Good Shepherd Centres | Individual and group social/recreational activities | $41,500 |

| Grace Anglican Church | Purchase of exterior freezer to store donations | $37,958 |

| Grenfell Ministries | Survival supplies for street-involved individuals | $10,000 |

| Hamilton & District Extend-A-Family | Transitions and program expansion | $15,000 |

| Hamilton Academy of Performing Arts | Subsidizing tickets for low-income households and seniors to attend The Nutcracker ballet in December | $5,000 |

| Hamilton Community Benefits Network | Extended medical, mental health, dental and paid sick days for precarious employees | $40,000 |

| Hamilton Community Legal Clinic/Clinique juridique communautaire de Hamilton | Speakers series - addressing hate crimes | $16,640 |

| Hamilton Community Legal Clinic/Clinique juridique communautaire de Hamilton | Social work supports for mental health consumers | $35,000 |

| Hamilton Downtown Mosque | Food kits for marginalized families | $27,878 |

| Hamilton East Kiwanis Boys and Girls Club | Operational support – grant writer and increased staffing hours | $23,000 |

| Hamilton East Kiwanis Boys and Girls Club | Meal kits for families in need | $16,000 |

| Hamilton Festival Theatre Company | Building box office and outreach capacity | $15,000 |

| Hamilton Filipino Community Centre (Sponsor: Jesus is Live Community Inc.) | Malasakit sa Kapwa: A pandemic response aid and data gathering for house-bound Filipinos in Hamilton | $5,000 |

| Hamilton Habitat for Humanity | Assisting with home repairs for low income individuals/families | $20,000 |

| Hamilton International Baptist Church | Tulong sa Pandemya: An aid response, organizing, and basic data collection project for care worker Filipinas in Hamilton | $5,000 |

| Hamilton Music Collective | Program continuation | $20,000 |

| Hamilton Theatre Inc. | Sound system installation and safety barriers | $10,000 |

| Hamilton Foundation for Student Success | Critical student needs | $100,000 |

| Hamilton Wentworth Catholic District School Board | Critical student needs | $80,000 |

| International Association For Refugees Canada | Providing support to refugee claimants | $13,361 |

| Immigrants Working Centre | Project supports for an Arabic speaking settlement worker | $28,702 |

| Indwell Community Homes | Enhanced support programs in Hamilton | $56,000 |

| Interval House of Hamilton | –Continued support for services of mobile mental health worker | $44,745 |

| Islamic Relief- IR Canada | Barakah Box - addressing food insecurity | $30,000 |

| Jennifer Ashleigh Children's Charity (JACC) | Food and shelter needs for seriously ill children in Hamilton | $5,000 |

| Learning Disabilities Association of Halton | Building capacity and advocacy support | $35,341 |

| Empowerment Squared | Computer lab upgrade | $26,220 |

| Liberty For Youth | Mentoring program | $30,000 |

| Living Rock Ministries | Youth drop-in and outreach | $34,000 |

| Mealshare Aid Foundation | Rebuilding to Help End Youth Hunger in Hamilton inking restaurants and charitable partners | $14,000 |

| Métis Women's Circle | Support for the recovery and mending of pandemic-disrupted relationships | $23,050 |

| Mishka Social Services | Sanad Case Management & Counselling Program | $25,000 |

| Munar Learning Center | Digital devices and IT support | $5,000 |

| Neighbour to Neighbour Centre | Support for coordinators of community gardens during COVID-19 | $7,000 |

| Neighbour to Neighbour Centre | Support to newcomers and persons experiencing ongoing barriers to settlement . | $25,000 |

| Niwasa Kendaaswin Teg | Indigenous support and food security | $50,000 |

| Options for Independent Living and Development | Increased hours for day-program staffing | $10,000 |

| Rainbow's End Community Development Corporation | Employment training for mental health consumers | $24,000 |

| Refuge: Hamilton Centre for Newcomer Health | Support for hiring and training interpreters and cultural facilitators | $20,000 |

| Ronald McDonald House Charities South Central Ontario | Providing food to families | $20,000 |

| Royal Botanical Gardens | Virtual school field trips | $10,000 |

| Second Harvest Canada | Revitalizing food rescue and distribution | $20,000 |

| Sex Workers' Action Program of Hamilton | Harm reduction packages for sex workers | $18,457 |

| Sexual Assault Centre (Hamilton and Area) | Support for victims of sexual assault | $64,480 |

| Shakespearience Performing Arts | Moving programming on-line | $5,500 |

| Shalem Mental Health Foundation | Outdoor, distanced art activities for youth | $17,212 |

| Start2Finish Canada | Mental health supports for families engaged in Start to Finish program | $10,000 |

| The AIDS Network | Food, PPE, and sanitary items | $30,000 |

| The Bridge From Prison to Community | Transitional housing program and wraparound reintegration supports | $15,000 |

| The Canadian National Institute for the Blind | Virtual programming addressing significantly increased isolation during COVID-19 | $15,000 |

| The Equestrian Association for the Disabled (T.E.A.D.) | Operating support for horses and therapeutic riding instructors | $15,000 |

| The Harlequin Singers of Hamilton | Operating support | $2,500 |

| The John Howard Society of Hamilton, Burlington & Area | Emergency release and reintegration services | $54,088 |

| The King's Way Outreach Centre | Supporting grant for operational costs | $25,000 |

| The Learning Partnership | Resources and activities to activate literacy, numeracy and play-based-learning | $13,600 |

| The Westdale Theatre | Family movie weekends | $10,000 |

| Threshold School of Building | Support for job developer position | $25,000 |

| Tottering Biped Theatre | Project adaptations | $20,000 |

| Wayside House of Hamilton | Integrated virtual care and communication program- men with addictions | $16,000 |

| Welcome Inn Community Centre | Food access and community visitation for seniors | $45,000 |

| Wellwood Resource Centre | –Self-care kits for people with cancer | $15,000 |

| YMCA of Hamilton/Burlington/Brantford | Support rent subsidies for residents facing eviction and for employment counselling services | $50,000 |

| YWCA Hamilton | Meals, engagement, & capacity building for transitional living program | $13,500 |

| Total | $2,080,562 |

| De dwa da dehs nye>s Aboriginal Health Centre | $25,000 |

| Elizabeth Fry Society | $5,000 |

| Essential Aid and Family Services of Ontario Inc. | $10,000 |

| Good Shepherd Centres Hamilton | $25,000 |

| Hamilton Community Legal Clinic | $10,000 |

| Hamilton Food Share | $50,000 |

| Hamilton Social Medicine Response Team (HamSMaRT) | $10,000 |

| Living Rock Ministries | $20,000 |

| Mission Services of Hamilton | $25,000 |

| Neighbour to Neighbour Centre (Hamilton) | $20,000 |

| Shelter Health Network | $10,000 |

| St. Matthew’s House | $10,000 |

| The Salvation Army Booth Centre | $25,000 |

| Welcome Inn Community Centre of Hamilton | $10,000 |

| Wesley Urban Ministries | $25,000 |

| YWCA Hamilton | $25,000 |

| Total | $305,000 |

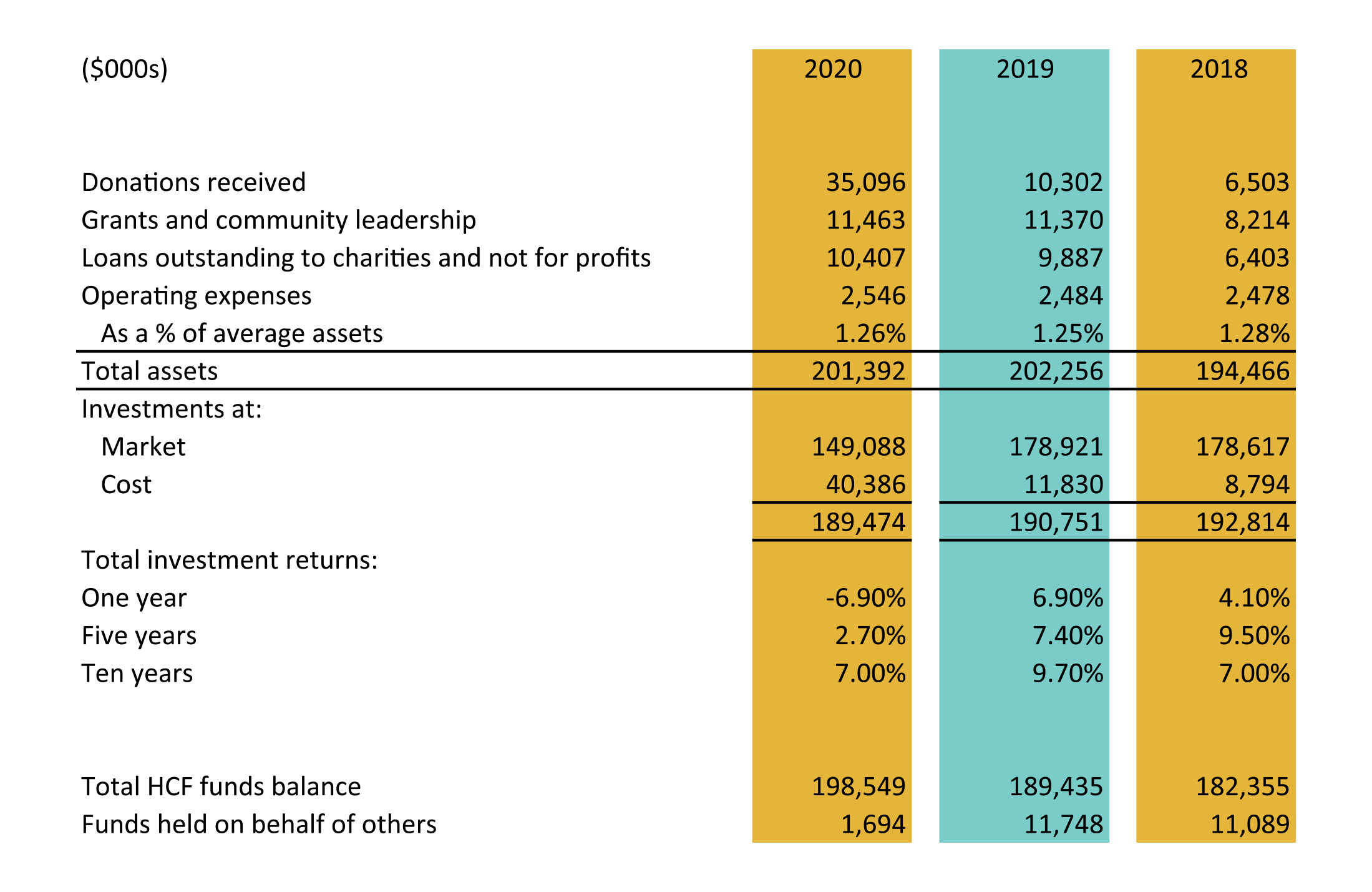

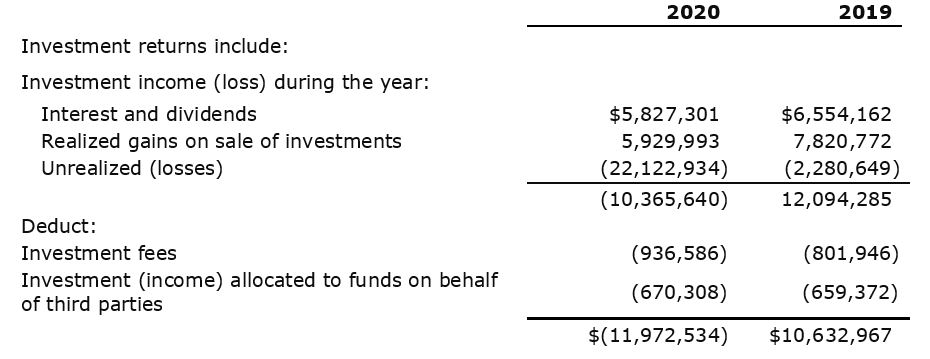

Donations to the Foundation are invested for the long term in public markets and in alternative investments. Investment income is then allocated annually to support granting, community leadership and operations. The summary and charts presented here provide both a financial snapshot and a history of recent activity that underlies the grants and community leadership activities represented in this annual report, made possible by remarkable donors.

Donations to the Foundation are from individuals, corporations and other charities. Donors may contribute to named endowment or flowthrough funds, to the Board-directed Community Fund, or to HCF’s community leadership projects.

The $35.1 million in donations this year is the second highest total in HCF’s history. Annual donations are influenced by the timing of the realization of donations in wills and significant one-time donations like the $27.7 million in donations of property and private equity. As illustrated in Chart 1, annual donations have ranged between $3.2 and $35.1 million over the past eight years. The five-year rolling average of donations ranges from $5.0 million to $13.3 million over the past eight years.

The five-year rolling average number of donations is 1,787 with 2019-20 at 1,853. The number of donations fluctuates based on “in memoriam” donations and the number and nature of events sponsored by donors to raise money for their funds.

Chart 1

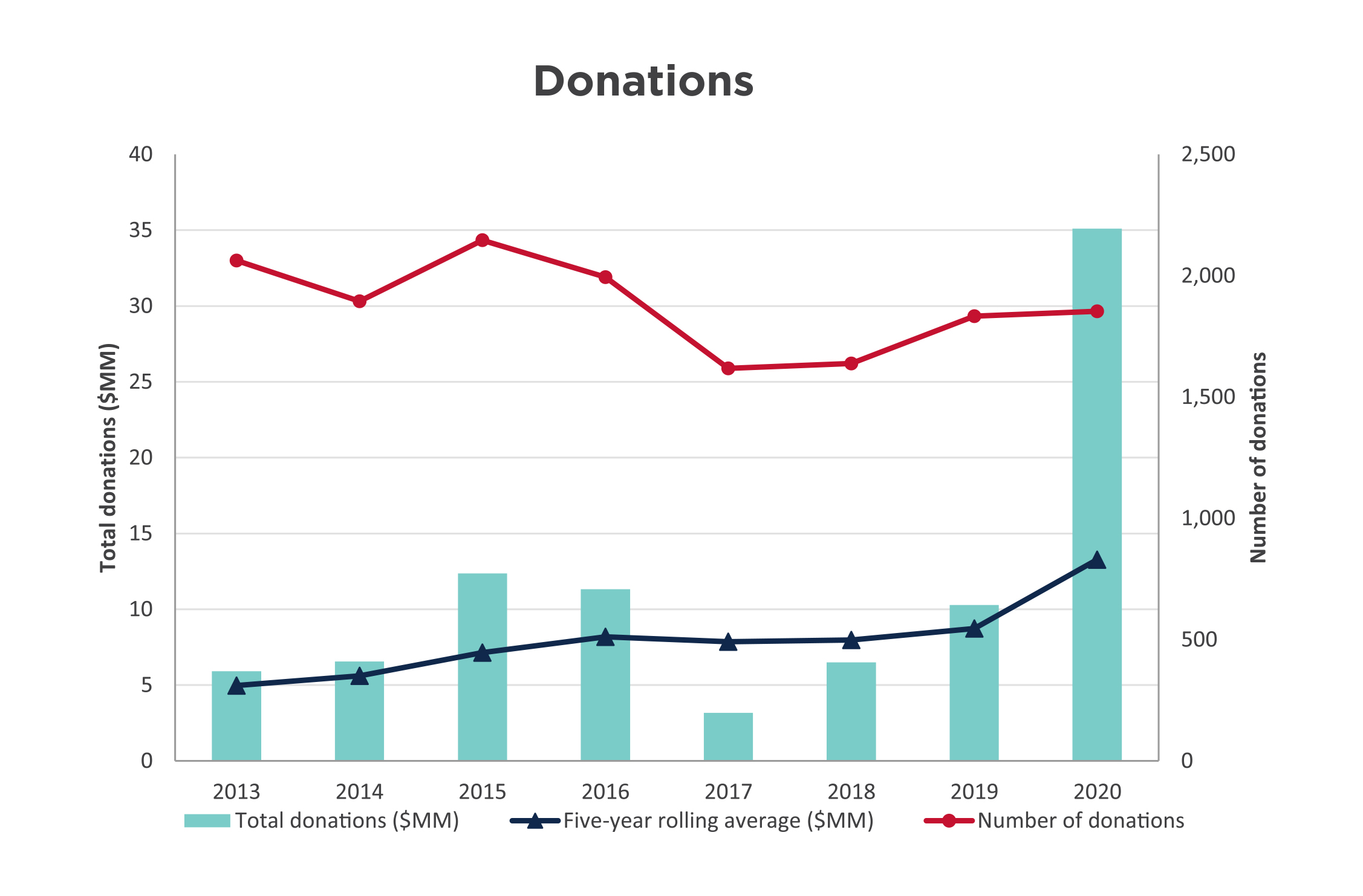

Grants are made annually from both endowed and flowthrough funds. Because flowthrough fund balances are distributed in a shorter time period, granting from these funds can materially influence HCF’s total annual amount granted.

As illustrated in Chart 2, grants and community leadership project spending over the past eight years has ranged from $4.7 million to this year’s historic high of $11.5 million. Granting from endowment funds was reduced in 2013 as a result of the decline in investment returns in 2012 which a) lowered the asset base used for the granting calculation (currently four percent of the fund balances), and b) resulted in less income available to grant. Flowthrough granting and expenditures on community leadership projects has ranged from 22 to 56 percent of total granting in any given year and is dependent on the timing and nature of flowthrough and project activity. At 893, the number of grants for this year is 37 percent higher than the eight-year average.

Chart 2

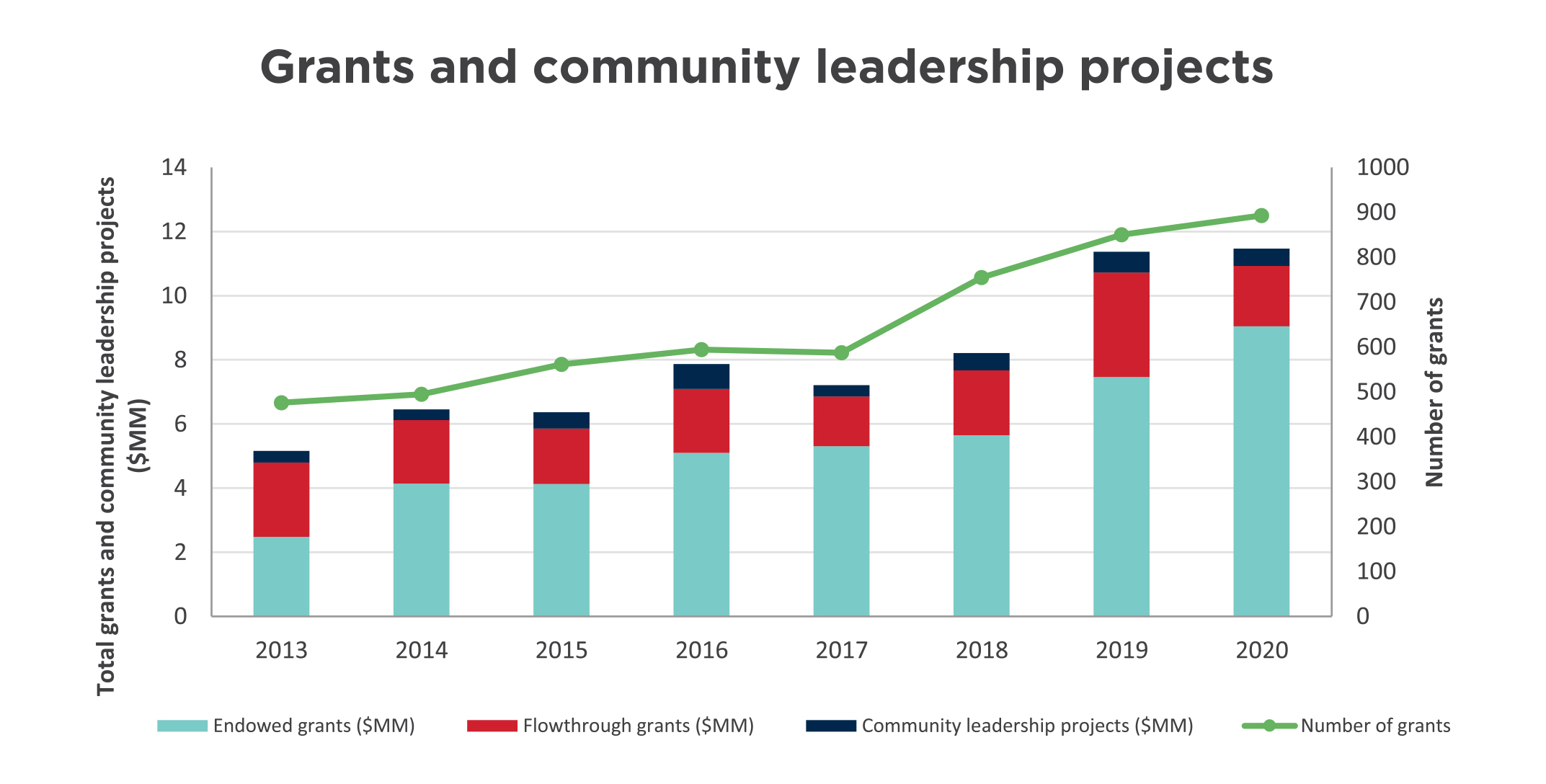

Investments traded in active markets are reported at fair market value. Investments not actively traded are recorded at their cost less any impairment of their value.

To support our strategy of aligning our assets with our mission and to provide a more diverse and robust portfolio, HCF has committed to investing in alternative asset classes including loans to charities and not-for-profits, private debt, real estate, infrastructure and private equity. These alternatives are consistent with the Foundation’s long-term investment horizon and liquidity requirements. Since these investments are not actively traded, they are valued at cost in the investments. These alternatives total $25.8 million.

HCF invests according to policy guidelines established by the Board of Directors. Two committees of the Board oversee investments to ensure compliance with the policy:

As an endowment builder, HCF’s policy focuses on long-term investing and is supported by reserve accounts that are currently at their policy maximum.

The investment policy sets out a total portfolio target asset mix, as well as a range around these targets. The public market investment managers have mandates within this targeted asset mix and use their discretion to invest the portfolios within this range. Chart 3 reflects the current and target asset mix. Note: $25 million of private equity relates to a fund established by a donor and is not part of the asset mix or the consolidated portfolio results.

Chart 3

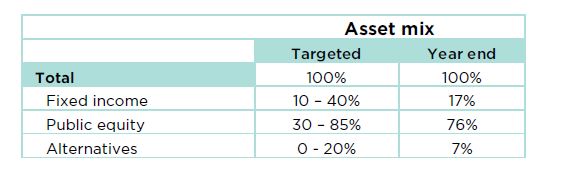

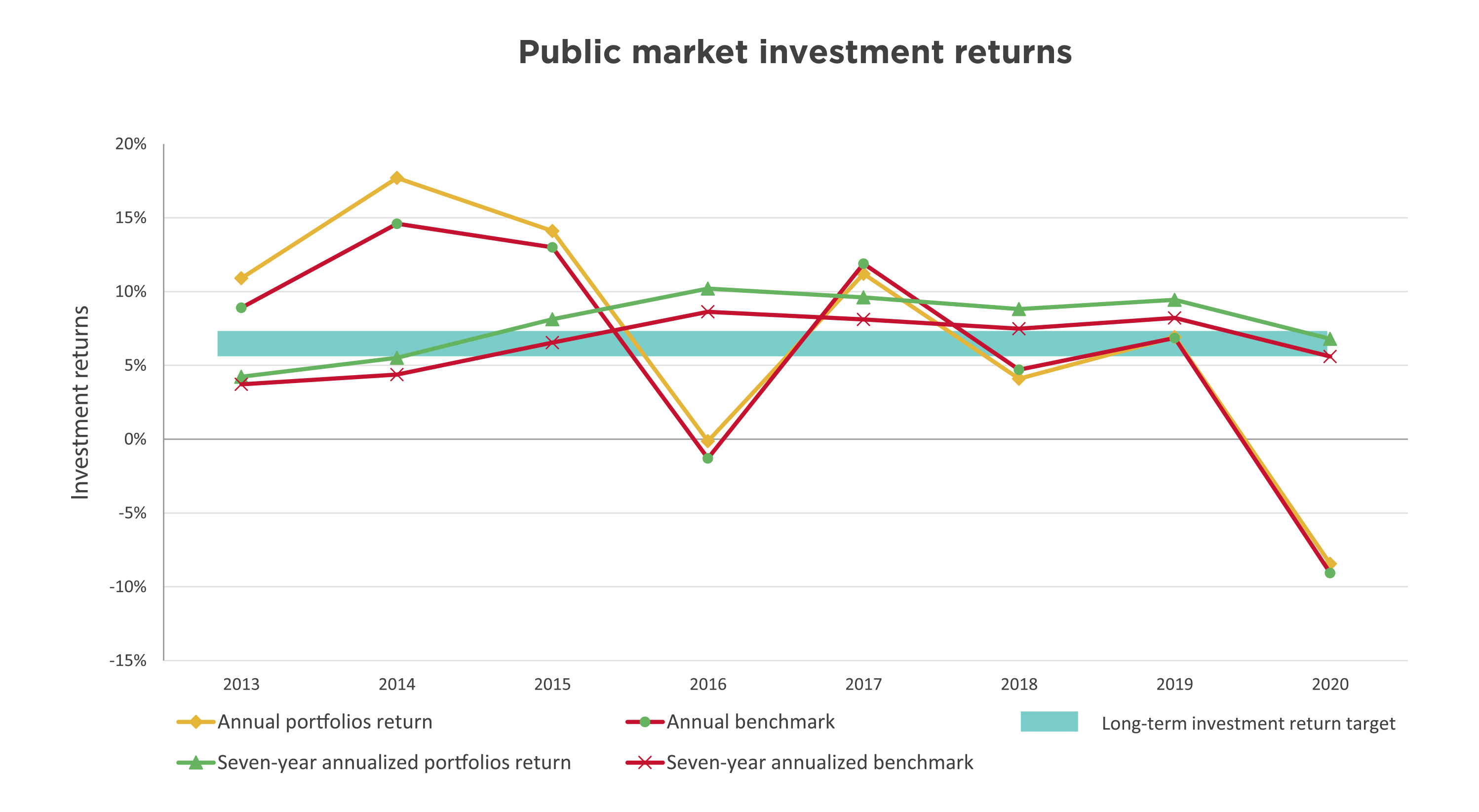

Two long-term portfolios are invested in the public markets with Jarislowsky Fraser, and Connor, Clark & Lunn. Chart 4 compares those portfolios against benchmarks as follows:

Benchmarks reflect the performance of each market index based on HCF’s specific target asset mix. Comparing actual results to the benchmark measures the value added by investment managers compared to the average market performance. HCF’s investment policy target is a long-term investment return in the 6.5 to 7.5 percent range.

Chart 4

The effect of the global pandemic has materially affected investment returns, resulting in a -8.4 percent public market return for the year. The seven-year annualized return at 6.8 percent is within the targeted investment policy range and is 1.2 percent higher than the 5.6 percent benchmark. As noted in the financial highlights, the current 10-year annualized return of 7.0 percent is in the target range and is higher than the benchmark by 1.2 percent.

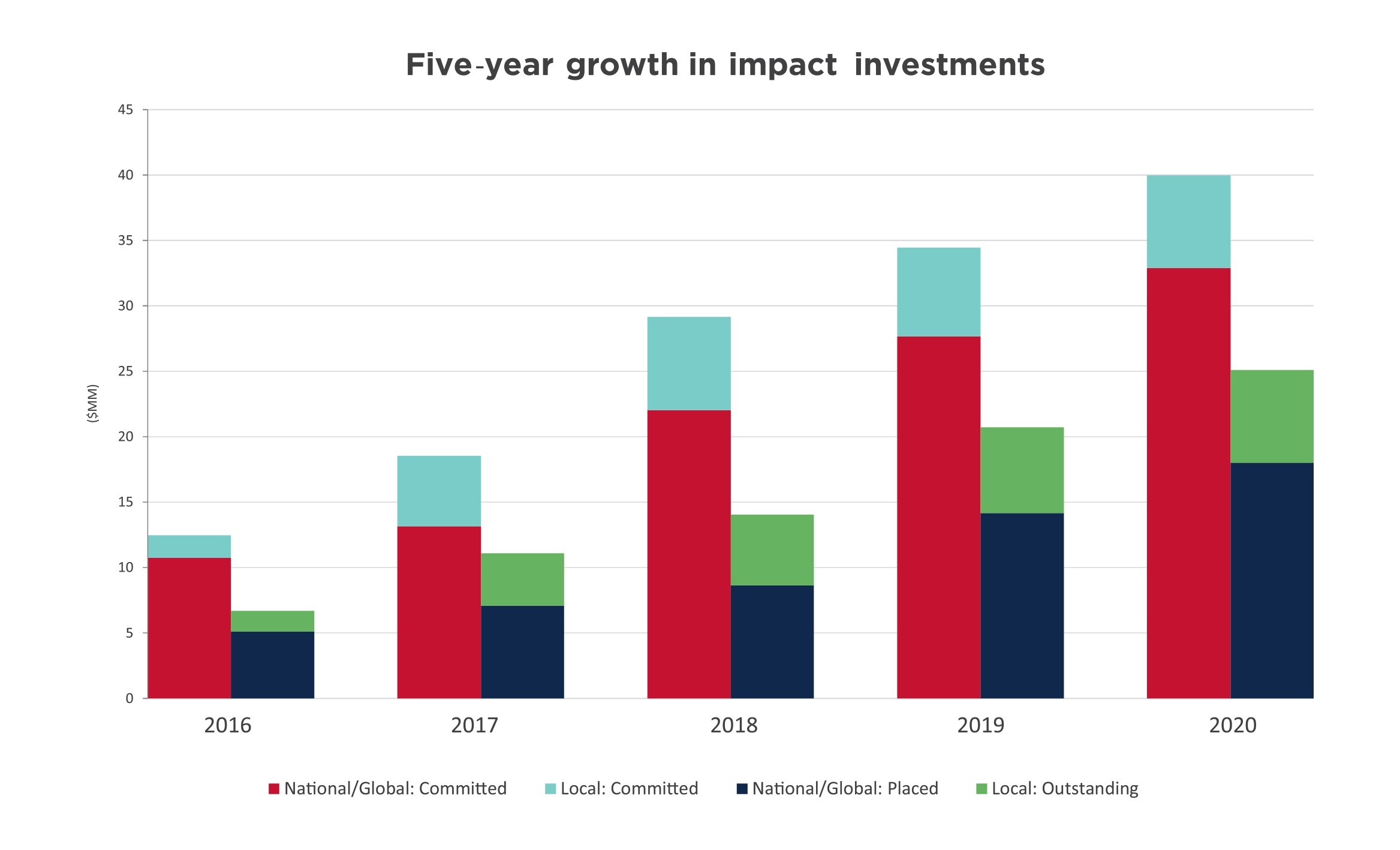

Impact investments enable donations to endowed funds to drive positive change beyond granting, because they represent investments of capital that deliver financial returns coupled with positive social and/or environmental outcomes. In addition, these investments provide a pool uncorrelated to the public markets which, in turn, buffers the portfolio from the volatility currently experienced.

More than 15 percent of our long-term assets are in impact investments. Chart 5 illustrates HCF’s impact investing progress over the past five years, with $25 million currently placed or outstanding and another $15 million committed. This brings the total commitment to $40 million, up from $34 million last year. Impact investments cover areas including affordable housing, arts, environment and sustainable development.

Chart 5

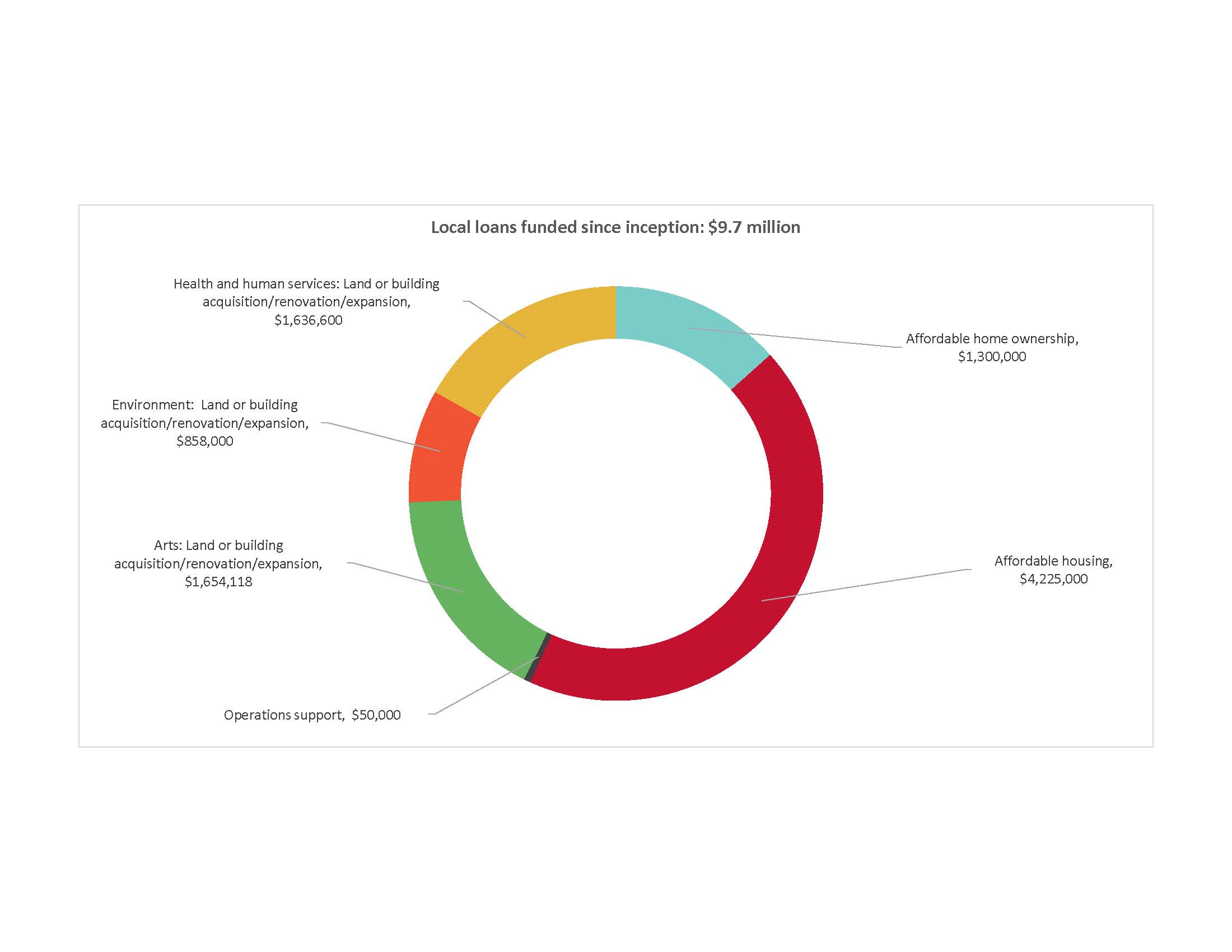

Local loans since inception total $9.7 million with $7.1 million outstanding at year end. Chart 6 shows the impact areas our loans have supported. Since the loan program’s 2012 inception, $2.6 million in loan principal has been repaid and recycled as new loans. In addition, the interest from these loans supports HCF granting.

Chart 6

IRP is a Government of Canada program being delivered nationally by partners including Community Foundations of Canada. As the first phase in the government’s long-term investment in social finance, the IRP’s goal is to make social-purpose organizations “investment ready” so they can make a difference in new and innovative ways through their participation in the social finance market. HCF has partnered with community foundations in London and Niagara, and the McMaster Innovation Park to manage the program regionally on behalf of Community Foundations of Canada. The first request for proposals for funding in January created enormous interest nationally and garnered 65 submissions to our regional partnership. Approved funding is expected to be released in June 2020. As an additional benefit, the IRP brought a growing number of potential opportunities for local loans to HCF’s attention.

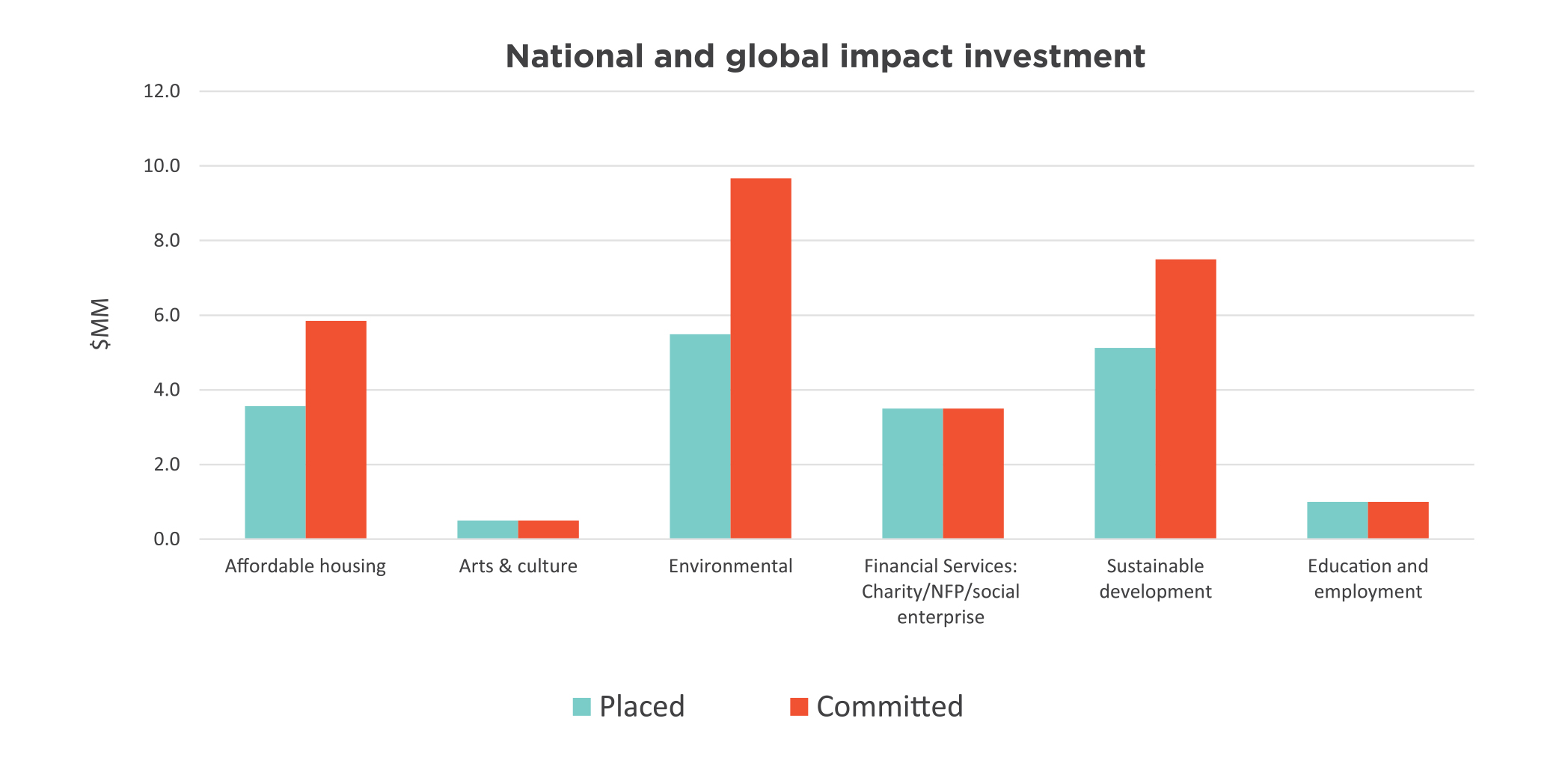

These investments include private equity, private debt and real estate investments. Many of these investments are long term in nature, are maintained at cost and do not have a regular income stream. As these investments are maintained at cost, their results include interest income and realized gains, but not unrealized gains. Results for these investments are closely monitored and are reported when realized. Chart 7 identifies the investment areas, with $18.0 million placed and a total commitment of $33 million across 21 investments.

Chart 7

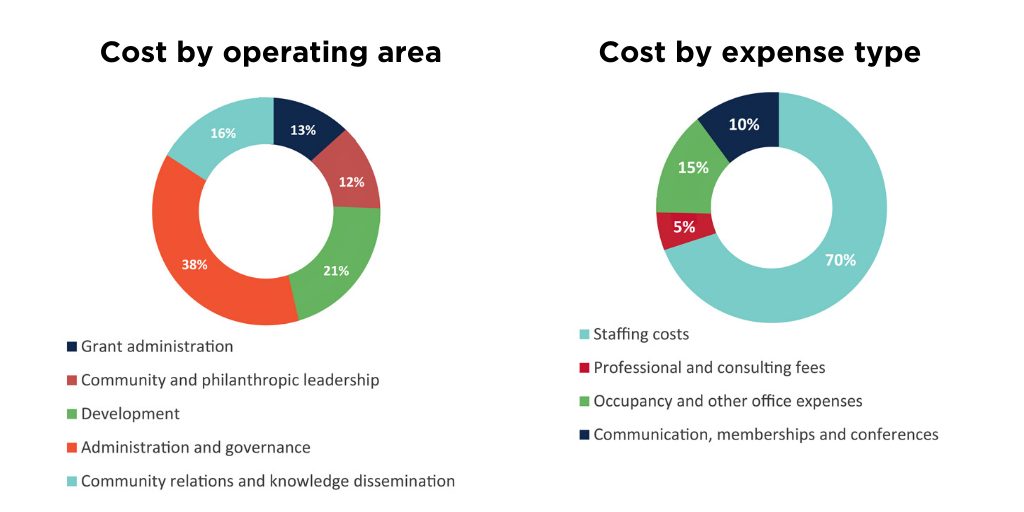

Operating expenses for the fiscal year ended March 31, 2020 total $2.5 million and were 2.5 percent higher than last year. Staffing costs related to the Foundation’s 22 employees represent 70 percent of HCF operating costs.

In addition to breaking out cost by type, operating costs are allocated to each of the Foundation’s operating areas: grants administration, community and philanthropic leadership, community relations and knowledge dissemination, development activities, and administration and governance. Examples of community and philanthropic leadership include convening around the city’s critical issues and fostering the growth of philanthropy by sharing staff time and knowledge to support other charities. Charts 8 and 9 illustrate these costs by operating area and by expense type.

Charts 8 and 9

The Foundation’s annual development expenses are not necessarily attributable to the donations received in that year. The nature of donations to the Foundation can result in costs preceding the receipt of the donation by several years (for example, donations through wills). As a result, consistent with the community foundation sector, operating costs are evaluated by a ratio of total operating expenses to average total assets. Ratios fall within a range depending on the size and stage of the community foundation’s development.

Management considers the ratio of 1.26 percent (1.25 percent in 2019), as illustrated in Chart 10, to be within an acceptable range for a foundation of HCF’s size, stage and level of community leadership, compared against benchmarks established in the community foundation sector. We continue to monitor both the actual results and the benchmarks on an ongoing basis.

Chart 10

Hamilton Community Foundation’s total assets of $201 million at March 31, 2020 include balances of HCF funds and funds held on behalf of others at $1.7 million.

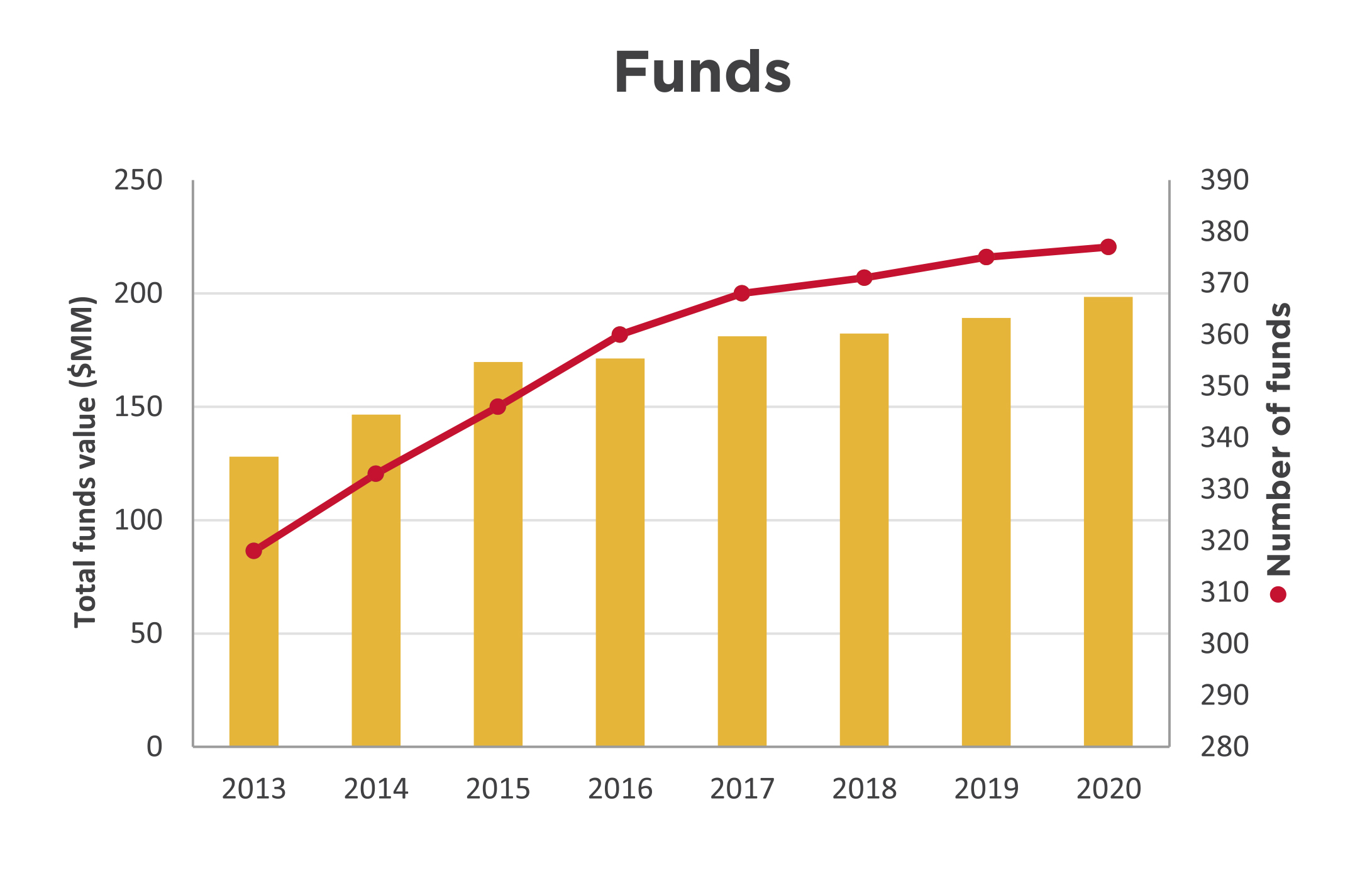

Hamilton Community Foundation’s fund balances, illustrated in Chart 11, represent accumulated donations plus the net investment earnings on these donations, minus granting and operating costs. Funds include both endowed and flowthrough funds. Endowed funds are held permanently and grant from investment earnings. Flowthrough funds are fully distributed as grants over a pre-determined term.

Chart 11

The fund balances have grown 55 percent to $198 million at the year ended March 31, 2020 from $128 million in 2013. Donations of $35.1 million included $4.4 million in flowthrough donations that were largely distributed as grants in the year and, as a result, do not remain in the fund balances at year end. This results in a modest total funds balance growth of 4.8 per cent for the year. The number of funds has grown 19 percent to 377 from 318 in 2013.

Auditors

BDO Canada LLP

Bankers & Custodian

Bank of Montreal and BMO Private Banking

Solicitors

Gowling WLG

Investment Managers

Connor, Clark and Lunn Private Capital Ltd.

Jarislowsky Fraser Ltd.

| Grants by recipient organization I-R | |

|---|---|

| ICNA Relief Food Bank | |

| Brant County | 10,000 |

| Imagine in the Park Children's Arts Festival/Rotary Club of Hamilton AM | |

| Supporting grant * | 3,000 |

| Industry Education Council of Hamilton | |

| Hamilton Code Clubs * | 176,430 |

| Indwell Community Homes | |

| Encouraging creativity and art expression * | 2,000 |

| Supporting grant * | 1,000 |

| Interval House of Hamilton | |

| Be More Than a Bystander | 1,000 |

| Mom's Rock | 5,000 |

| Supporting grant | 9,603 |

| The Hero's Journey Program * | 10,000 |

| Jazz.FM91 Inc. | |

| Supporting grant | 598 |

| The John Howard Society | |

| ACHIEVES * | 180,000 |

| YARD program * | 60,937 |

| Joseph Brant Hospital Foundation | |

| Supporting grant | 10,500 |

| Journalists for Human Rights | |

| Supporting grant | 50,000 |

| Jump In Foundation | |

| Physical activation program | 10,000 |

| Jump Math | |

| Supporting grant | 50,000 |

| Juravinski Hospital & Cancer Centre Foundation/Hamilton Health Sciences Foundation | |

| Supporting grant | 2,000 |

| Juvenile Diabetes Research Foundation | |

| Supporting grant | 1,145 |

| Kitchener Waterloo Community Foundation | |

| Green Shield Canada Sherry Peister Community Impact Fund | 490,000 |

| Lake Avenue Elementary School/Hamilton Foundation for Student Success | |

| Flash mob presentations | 3,000 |

| Makerspace Across the Grades | 5,000 |

| L'Arche Hamilton | |

| Community Café | 23,270 |

| Creative Hands Art Studio * | 9,725 |

| Supporting grant | 650 |

| Learning Disabilities Association of Halton | |

| Reading Rocks expansion and subsidies * | 2,500 |

| Reading Rocks literacy intervention * | 7,225 |

| The Learning Partnership | |

| Entrepreneurial Adventure * | 10,000 |

| Supporting grant | 25,000 |

| Let's Talk Science | |

| Youth in a digital future * | 10,000 |

| Supporting grant | 25,000 |

| Liberty for Youth | |

| Bright Choices * | 10,000 |

| Prodigal Sonz * | 5,000 |

| Lighthouse Program for Grieving Children | |

| Supporting grant | 3,000 |

| Lions Foundation of Canada | |

| Autism Assistance Dog Guide Program | 2,000 |

| Canine Vision Canada | 1,785 |

| Wishlist | 1,000 |

| Living Rock Ministries | |

| Arts of August | 1,400 |

| Operation Christmas Blessing | 4,000 |

| Pandemic relief * | 20,000 |

| Rock Resources | 25,000 |

| Street-involved young moms | 650 |

| Supporting grant | 2,000 |

| Supporting grant * | 8,007 |

| Weekend program | 11,609 |

| Loran Scholars Foundation | |

| Supporting grant | 80,000 |

| Lynwood Charlton Centre | |

| Under the Willows | 20,000 |

| Supporting grant * | 4,402 |

| MacNab Street Presbyterian Church | |

| Supporting grant | 11,959 |

| Make-A-Wish Foundation | |

| Supporting grant | 500 |

| March of Dimes Canada Non-Profit Housing Corporation | |

| Jason's House | 2,000 |

| MaRS Discovery District | |

| Centre for Impact Investing | 75,000 |

| Solutions Lab | 150,000 |

| SVX | 25,000 |

| Mathstronauts/McMaster University | |

| STEAM Engine Program * | 38,390 |

| McGill University | |

| Friends of McGill Hockey | 200 |

| School of Nursing | 2,000 |

| McMaster University | |

| Art Gallery | 2,000 |

| McMaster Community Poverty Initiative | 2,500 |

| MCYU and Neighbour to Neighbour Mentorship Program * | 18,700 |

| Midwifery bursary | 10,000 |

| Museum of Art | 1,940 |

| Mealshare Aid Foundation | |

| Tackling Youth Hunger in Hamilton | 20,000 |

| Melrose United Church | |

| Supporting grant | 6,238 |

| Mission Services of Hamilton | |

| Pandemic relief * | 25,000 |

| Supporting grant | 11,704 |

| The 196 * | 124,950 |

| Youth Wellness Program | 15,000 |

| Missionaries of Charity | |

| Supporting grant | 200 |

| Mohawk College | |

| Pathfinder Program | 35,000 |

| MADD Canada | |

| SmartWheels | 2,000 |

| Musicata | |

| Supporting grant | 2,000 |

| Muskoka Conservancy | |

| Supporting grant | 2,000 |

| Neighbour to Neighbour Centre (Hamilton) | |

| Children and Senior Chinese Community Folk Dance * | 500 |

| Community Food Centre - Peer Advocate Skills Mentorship | 2,000 |

| Eco-Explorers and Eco-Advocates * | 10,000 |

| Food skills programming | 15,000 |

| Jack Parent Reading Program | 1,040 |

| Jack Parent Reading Program * | 15,000 |

| Math Success Program * | 52,000 |

| Pandemic relief * | 20,000 |

| Net Ministries of Canada | |

| Supporting grant | 2,000 |

| Never Gonna Stop Community Centre for the Arts/Hamilton Centre for Civic Inclusion | |

| Summer programming * | 2,000 |

| New Hope Community Bikes | |

| Ride Smart * | 10,000 |

| New Vision United Church | |

| Supporting grant * | 10,084 |

| Niwasa Kendaaswin Teg | |

| Completing the Circle | 25,000 |

| NYA:WEH Elementary - HWCDSB * | 180,000 |

| NYA:WEH Elementary - HWDSB * | 360,000 |

| Traditional Knowledge and Skills Outreach * | 20,000 |

| No. 9 Contemporary Art & the Environment | |

| Imagining My Sustainable Community Hamilton * | 44,000 |

| Notre-Dame de Perpetual-Secours | |

| Supporting grant | 23,200 |

| The Owl Foundation | |

| Supporting grant | 4,500 |

| Paroisse Saint-Philippe | |

| Supporting grant | 8,000 |

| Pathways to Education Canada | |

| Supporting grant * | 10,000 |

| Philpott Memorial Church | |

| Supporting grant | 9,096 |

| Players' Guild of Hamilton Inc. | |

| Supporting grant * | 5,105 |

| Prince of Wales Public School / Hamilton Foundation for Student Success | |

| Healthy Cooking on a Budget | 5,000 |

| Queen Mary School / Hamilton Foundation for Student Success | |

| Student programming | 5,000 |

| Rainbow Railroad | |

| Supporting grant | 10,000 |

| Rainbow's End Community Development Corporation | |

| Growing Strong | 25,000 |

| Re-create Outreach Art Studio/Shalem Mental Health Network | |

| Art Journaling: Drawing our way towards mental health * | 3,839 |

| Textile Stories * | 11,425 |

| Redeemer University College | |

| Supporting grant | 4,000 |

| The Rob Freeman Foundation | |

| Supporting grant | 2,500 |

| Robert Land Community Association/Eva Rothwell Centre | |

| Supporting grant | 4,424 |

| Roman Catholic Episcopal Corporation of the Diocese of Hamilton | |

| Haiti Fund | 2,000 |

| One Heart, One Soul Campaign | 10,000 |

| Roman Catholic Episcopal Corporation St. Ann's Parish | |

| Supporting grant | 8,000 |

| Rotary Club of Hamilton AM | |

| Imagine in the Park Children's Arts Festival | 3,000 |

| Rotary Club of Hamilton Sunshine Fund | |

| Children's Christmas Celebration | 2,650 |

| CORE Kids - Youth Achievers Program * | 25,000 |

| Supporting grant * | 8,007 |

| Royal Botanical Gardens | |

| Supporting grant | 11,871 |

| Supporting grant * | 3,883 |

| Royal Canadian Humane Association | |

| Supporting grant * | 3,621 |

| Royal Conservatory of Music | |

| Supporting grant | 500 |

| Rygiel Homes Housing Corporation | |

| Supporting grant | 1,000 |

| Rygiel Supports for Community Living | |

| Supporting grant | 2,274 |

| Supporting grant * | 1,713 |

This fund is used to address the highest charitable priorities in the community.

| Fund | Amount |

|---|---|

| #HamOnt Forever Fund | 5,000 |

| A. May Davis Fund | 41,598 |

| A.H. Tallman Bronze Co. Ltd. Fund | 21,790 |

| Alfred Charles & Pearl Gertrude Swanwick Fund | 200,000 |

| Alice Redman Gooch Fund | 25,025 |

| Alice Vera Morgan Fund | 338,065 |

| Alphonse Dirse Fund | 48,344 |

| Anne M. Biggar Fund | 460,327 |

| Annie S. Nieman Fund | 36,081 |

| Anonymous fund | 81,942 |

| Averil Gray & Florence Gray Fund | 1,172,308 |

| Bertha Savage Fund | 47,806 |

| Brenda & Reg McGuire Fund | 5,150 |

| Brenda Morris Fund | 5,000 |

| Cameron K. MacGillivray Fund | 9,325 |

| Caroline May Alvey Fund | 118,000 |

| Catherine C.H. Murray Fund | 50,050 |

| Charles & Catherine Ralph Fund | 43,131 |

| Charlotte Cauley Fund | 34,987 |

| Christina Cooper Fund | 173,405 |

| Christina I. Hammant Fund | 250,000 |

| Clare B. Hunter Fund | 13,079 |

| D. Argue Martin Fund | 20,340 |

| Dan and Helen Geagan Fund | 20,174 |

| Daniel T. Lawrie Fund | 115,529 |

| Diffey Family Fund | 5,000 |

| Donald A. Cooper Fund | 40,126 |

| Donald & Alice Cannon Fund | 14,625 |

| Donald H. Henderson Fund | 408,597 |

| Donald J. Allan Fund | 103,514 |

| Doreen & Gordon Birk Fund | 98,409 |

| Doris M. Allen Fund | 172,918 |

| Dorothy & Travice Broadbent Fund | 7,000 |

| Dorothy Cauley Fund | 78,831 |

| Dorothy I. Linfoot Fund | 20,588 |

| Dr. Alexander A. Numbers Fund | 5,844 |

| Dr. Carl Martin Memorial Fund | 5,000 |

| Dr. Ronald P. Graham Fund | 16,814 |

| E. Francis Dennee Fund | 24,322 |

| Edna E.R. Reeves Fund | 78,766 |

| Edna Fern Flewelling Fund | 29,761 |

| Edna Robertson Memorial Fund | 29,000 |

| Eleanor Foster Fund | 869,072 |

| Eleanor Jean Milton Fund | 63,610 |

| Eleanor M. Smith Fund | 10,000 |

| Elizabeth Lee Fund | 11,775 |

| Elizabeth Mary Hamilton Fund | 30,000 |

| Elsie M. Husband Fund | 12,300 |

| Erie Hossack Fund | 58,638 |

| Erma Z.L. Goering Fund | 888,437 |

| Ernest & Ruth Brunton Fund | 28,000 |

| Ethel H. Prouse Fund | 181,684 |

| Eulalia D. Wall Fund | 170,977 |

| Evelyn & Richard Geraghty Storms Memorial Fund | 25,000 |

| Evelyn Patricia Lyons Fund | 5,000 |

| Fell Family Fund | 38,065 |

| Flora L. McNeil Fund | 30,165 |

| Florabel Condy Fund | 25,000 |

| Frances W. Ambrose Fund | 5,600 |

| Francis Spence Hutton Fund | 32,650 |

| Frederick J. Mills Fund | 26,189 |

| Gallagher Family Fund | 82,700 |

| George Earle Drewett and Arline Myra Drewett Memorial Fund | 50,000 |

| Gilbert P.V. Belton Fund | 175,088 |

| Gladys A. Whittaker Fund | 26,205 |

| Gordon & Ethel Holmes Fund | 97,572 |

| Grace J. Smith Fund | 13,030 |

| Hanna & Joseph Dubeck Fund | 5,000 |

| Harold E. Clarke Fund | 86,120 |

| Harvey and Audrey Smith Fund | 544,860 |

| Helen Gertrude Harrison Fund | 34,222 |

| Helen Mary Archambeault Fund | 25,316 |

| Henrietta F. Campbell Fund | 104,959 |

| Herbert P. and I. Flora Frid Fund | 354,466 |

| Horace A. Bennett Fund | 10,000 |

| Howard & Edna Tugman Memorial Fund | 100,000 |

| Ian & Donna Cowan Fund | 5,750 |

| Irene Caldwell Memorial Fund | 10,000 |

| J.M. Walter Hahn Fund | 5,000 |

| Jack A. Winser Fund | 155,007 |

| Jack McNie Fund | 26,000 |

| James & Irene Wilson Fund | 6,000 |

| James & Mary Phin Fund | 106,545 |

| James D. Redmond Fund | 6,033 |

| Jane Milanetti Fund | 13,450 |

| Jessie Rumney Fund | 10,000 |

| Joan W. Rutherford Fund | 5,000 |

| John and Joan Bothwell Fund | 10,000 |

| John H. Frid Fund | 548,347 |

| John Shea Memorial Fund | 8,387 |

| Josephine Magee Fund | 204,057 |

| Kathleen L. McBride Fund | 11,632,794 |

| Kathryn Jones Fund | 30,186 |

| Lakin Family Fund | 14,580 |

| Laurence Cholwill Patterson Fund | 351,146 |

| Leanora M. Spicer Fund | 26,600 |

| Lillian Boyd Barnby Fund | 10,000 |

| Lindsay M. McLennan Fund | 78,022 |

| Lois G. Greenall Fund | 145,085 |

| Lulu Blanche Hart & Harry Utter Hart Memorial Fund | 778,782 |

| M. Jessie Chagnon Fund | 71,196 |

| Mabel Beatrice Studd Fund | 15,000 |

| Mabel D. Leadlay Fund | 75,891 |

| Margaret & William Gilmour Fund | 8,380 |

| Margaret Anne Hayward Fund | 797,598 |

| Margaret E. Tschetter Fund | 383,739 |

| Marjorie L. Allan Fund | 5,000 |

| Marjorie Wild Fund | 30,724 |

| Marnie & Bill Brehm Family Fund | 39,500 |

| Marnie Spears Fund | 22,195 |

| Martha McKinnell Serrels Fund | 94,682 |

| Mary & Earl Brooks Fund | 1,354,969 |

| Mary E. Hatch Fund | 116,000 |

| Mildred E. Hunter Fund | 100,878 |

| Mount Hamilton United Church Legacy Fund | 20,000 |

| Noreen & Seymour Wigle Fund | 15,000 |

| Patricia Eileen Smith Fund | 5,150 |

| Peter & Rose Marie Palmer Fund | 7,385 |

| Petra Cooke Memorial Fund | 31,300 |

| Project Sunday Fund | 8,771 |

| Ralph E. Ingraham Fund | 16,017 |

| Ralph W. & Evelyn J. Cooper Fund | 151,000 |

| Renate & Bob Davidson Fund | 11,000 |

| Reynolds Family Fund | 141,839 |

| Robert C. & L. Ann Glass Fund | 100,000 |

| Robert D. Crockford Fund | 14,075 |

| Robert George Sparre Fund | 34,410 |

| Robert J. & Joan Harrison Fund | 10,266 |

| Robert P. McBride Fund | 1,636,012 |

| Royal Hamilton College of Music Faculty Fund | 5,963 |

| Russell & Mae Lindley Fund | 10,400 |

| Ruth G. & Fred J. Spencer Fund | 23,000 |

| The Samuel & Dora McFarlane Fund | 14,000 |

| Samuel Ringer Fund | 70,586 |

| Sandra & John Black Fund | 160,594 |

| Sarah Smith Fund | 230,729 |

| The Spectator Fund | 10,000 |

| Stait Family Fund | |

| Stewart Philp Fund | 45,000 |

| Tim and Dale Langs Fund | 189,409 |

| Tod Laing Fund | 7,950 |

| The Unicorn Fund | 12,611 |

| Vangie M. Crosthwaite Fund | 41,292 |

| Vera M. Elwin Fund | 536,235 |

| Vincenza Travale Fund | 21,200 |

| W. Jones Fund | 25,920 |

| West-Moynes Fund | 8,500 |

| Wheeler Family Fund | 10,900 |

| William F. Brand Fund | 8,404 |

| William Gordon Kitchener Fund | 60,000 |

| William S. Sparham Fund | 25,236 |

| Thank you to our 2019-20 donors: | ||

|---|---|---|

| Layla Abdulrahim-Moore | Matt & Sarah Goodman | Scott Page & Vanessa Foreman Page |

| Mary Aduckiewicz | Susan Goodman | Peter & Rose Marie Palmer |

| Agro Zaffiro LLP | Grant Thornton LLP | Michael Parente |

| Jane E. Allison | Green Shield Canada | Jane E. Peacock |

| Jane Anderson | Lisa Habisreutinger | Jennifer Pearson |

| Jill Anderson | Tanis Hall | Terri Petrachek |

| Peter Anderson | Brian & Morag Halsey | Raong Phalavong |

| Maria Antonakos | David Hamber | Shirley Picken |

| Annette Aquin & David Malcolm | Hamilton Foundation for Student Success | The Pioneer Group Inc. |

| Callie Archer | Hamilton Health Sciences Corporation | Steve & Mary Prime |

| H. Anthony & Anne Arrell | Hamilton Law Association | Elisha Proietti |

| The Honourable Harrison S. Arrell & Diane Arrell | Hamilton Technology Centre | Punk Rock Realty, Inc. |

| The Atkinson Charitable Foundation | Annette Hamm | Judith Pyke |

| Robert & Carol Balint | Elizabeth Harris | Rally Assets Inc. |

| JoAnne Barresi | Roberta D. Harris | Carol Rand |

| Glenn & Kim Barrett | Barbara Harwood | Gail Rappolt |

| Dr. Philippe & Mary Barrette | Rhoda Hassmann | Diane Rawsthorn |

| Bay Area Science & Engineering Fair | Hasty Market Corporation | Jim Ray & Annette Dufresne-Ray |

| Bentley Systems, Incorporated | Ruth Hatch | Paul Ray |

| Robert P. Beres | Maureen Hayes | Brian Reid |

| Robert & Marion Bethune | Dr. Joan B. Heels | Heather Rex |

| Bike for Mike supporters | Corey Helie-Masters | Gabrielle Richards |

| Charles & Rosi Bisaro | Rob & Tami Henderson | Don & Ann Ridpath |

| John & Sandra Black | Heidi Henschel | Rise and Shine-Strategic B2B Content Marketing |

| Julie Boateng | Thomas A. Hickey | Carol Ritchie |

| Katharine L. Borczak | Higher Education Quality Council of Ontario (HEQCO) | Tanya Ritchie |

| Edward G. & Karin Bossence | Geoffrey H. Hogarth | Susan M. Roberts |

| Duane Bouyea | Cathy Holland | Gail Robinson-Gow |

| Katherine Braedley | Assad Hoosein | Barbara E. Rogers |

| Maria Bragues | Nathan H. Hough | Larry Roos |

| Bill & Marnie Brehm | Wendy J. Hough | Rotary Club of Hamilton Sunshine Fund |

| Adele Brierley | Emily M. Hunt | Nancy K. Rundle |

| Ray Brillinger & Cy Hack | Bruce & Linda Hutchinson | John & Dr. Leila W. M. Ryan |

| Broadcast Services International Inc. | The Hutton family | Sheila Sammon |

| Hazel M. Broker | Dean Jeffries | Brennan Sarich |

| Browne Law Office Professional Corporation | Shirley A. Johnson | Stu Saunders |

| Ernest & Ruth Brunton | Nigel Johnston | Bob & Peggy Savage |

| Burlington Parks & Open Space Friends | Rosalind Johnston | Erik Schaefer & Amy Lazier Schaefer |

| Mary Buzzell | Jim Jones | Sandy J. Schwenger |

| Cake & Loaf Bakery Ltd. | Kabuki Spa & Skin Centre | Stan & Keitha Seneco |

| Dr. Gordon Cameron | Greg & Danielle Kaiser | Lori Serafini |

| Neil & Judy Cameron | Barry J. Kay | Karen Shaver |

| Ward Campbell | Jennifer Kaye | Donna Sheldrake |

| Alice A. Cannon | Katharine R. Kingsmill Marsales | Courtney Sheppard |

| Janet E. A. Cannon | Carolyn Kinsley | Jonathan Shrubsole |

| Paul & Sara Cannon | Helen Kirkpatrick | Risa Shuman |

| Stewart & Jane Capell | Rob & Melissa Klaver | Teresa Silvestro |

| Richard & Carole Capling | Mike A. Kluk | John Simpson |

| Mike Carnegie | Marinus J. Kok | Kim Smith |

| Dr. Ignacio Castillo | Miriam P. Kramer | Teresa Smith |

| Sharon Charters | John Krawchenko | Melanie Sodtka |

| Denise Christopherson | Alyssa Lai | Marnie Spears |

| Benjamin J. Ciprietti | Sara Laidlaw | St. Joseph's Health System |

| City of Hamilton | Paul & Pam Lakin | Victoria Staite |

| Alan & Marlies Clark | Stuart Laurie | Sandra Stephenson |

| John Clinton | Janice M. Lawson | Doreen Stermann |

| Derek Collins | Melissa Leaist | Patrick K. Sun |

| Columbia International College | Ann Leon | Carolyn F. Swadron |

| Connor, Clark & Lunn Foundation | Elizabeth Lesser | Charles & Ret Swire |

| Conserver Society of Hamilton & District, Inc. | Dr. Mark & Hinda Levine | Glen & Debra Swire |

| Terry Cooke & Maureen Wilson | Joy Levy | Elisha Szafran |

| William Cooke | Angel Li | Pauline Taggart |

| Elizabeth Coons | Dr. Dana Liang | Rose Taylor-Weale |

| Chantal Copithorn | Celeste Licorish | Anne Tennier |

| Georgia Corkins | Lodge of the Ancient Landmarks | Dr. Robert & Deborah Tester |

| R. Ian Cowan | Losani Family Foundation Fund supporters | Joshua E., Amy & Liam Thorne |

| Jeannie Crawford | Joan Lowry | Margaret E. Thurston |

| Robert D. Crockford | John MacDonald & Susan Greer | Helen Tomasik |

| Francina Cunningham | Shylah MacIntyre | Dr. Ninh Tran & Sarah Bennett |

| Margaret Cunnington | Alix MacLean | Vincenza Travale |

| Ray & Joanne Cunnington | E. Shirley Macnamara | Ross & C. Anne Tucker |

| Lisa Dalia | Jean Madadi | Kerry Turcotte |

| Dr. Juliet Daniel | Dr. Kim Madden | Laura Turkstra |

| Kenna-Lynn Danyliw | Maple Leaf Centre for Action on Food Security | Peter & Karen Turkstra |

| Dr. Liane Davey | Rick & Anne Martin | Sarah Turkstra |

| Bob & Renate Davidson | Ginny Mattuzzi | Laura Tutte |

| Rosaline Dean | Mary McClelland | Kenneth J. Tyler |

| Paul Del Bello | Stacie McCormick | Unicorn Rebellion |

| William M. & Susan J. Dell | Sheila M. McDougall | UnMarketing Inc. |

| Sabrina Denicola | James & Laura McGrath | Mark & Jentine Van Beveren |

| Francis A. DeSantis | Dr. Don & Kathryne McLean | Joan Van Damme |

| Alan R. & Joan Dessau | McMaster University | Paul Vayda |

| Lori Dessau Tauber | McMaster University Women’s Health Review | Vincero Capital Management Inc. |

| Terry & Grace Diffey | Wendy McNally | Alan & Janet Walker |

| Kevin & Karen Dore | Rev. Alan & Maureen McPherson | Geoffrey F. & Joan Walker |

| Dr. Bob Kemp Hospice Foundation | Archie J. McQueen | Randall E. Walker |

| Sandra L. Edrupt | The Honourable Derek Mendes da Costa | Barbara J. Wallace |

| Julie Ellis | Virginia Mendes da Costa | Patricia A. Walsh |

| William Ernst | Grahame & Sheree Meredith | Yulena Wan & Scott Newport |

| Dr. Bill & Jane Evans | Ruth Merz | Sarah Wardrope |

| Lois Evans | The Honourable Jane A. Milanetti | Dr. Gary & Joy Warner |

| The Fairmount Foundation | John Mills Sr. | Kathy Watts |

| Kate Feightner | Paul & Carolyn Milne | Dr. Sarah Wayland |

| Don Fell | Martha Mitchell | Beth Webel |

| Fengate Asset Management | Alan Moffett | Trevor Westerhoff |

| The Honourable William Festeryga & Doris Festeryga | Mortgage Teacher | Kate Whalen |

| Find the Red Thread | Jenna Morton | Jean & John Wheeler |

| Margaret Fischbuch | Dr. Henry & Betty Muggah | Rob Wiersma & Tracy Varcoe |

| Frank & Lydia Fitz | Christina Mulder | Boris Williams & Sunniva Buskermolen |

| Peter & Gaye Fletcher | Justin Mulder | Gwyn & Gail Williams |

| Tom Flood | William & Patricia Mungar | Peter B. Williamson |

| FMC Truck Auto & Marine | Sarah M. Murphy | Robin L. Williamson |

| Freewheel Cycle Inc. | Joyce Neal | Richard Wilson |

| Melanie Froese | Richard Nelson | Veronica Wilson |

| Patricia Fulton | Christopher Nichols | The Winnipeg Foundation |

| Paul Gibel | John & Anna M. Nisbet | Marnie Wolfe |

| Mary S. Gilmour | Dermot P. Nolan | Marita Zaffiro |

| Richard & Justine Giuliani | Erin O'Neil | Juliana Zaremba |

| Patricia Glover | Gerry & Sheila O'Reilly | Zonta Club of Hamilton I |

| Bruce Goodbrand & Donna Tweedell | Eileen Page | |

| We would like to acknowledge those people who made a direct financial contribution to ABACUS in 2019-20: | ||

|---|---|---|

| Bentley Systems, Incorporated | Sarah Glen | Dr. Henry & Betty Muggah |

| The Fairmount Foundation | Lisa Habisreutinger | Rose Taylor-Weale |

| Grants from designated funds | Amount |

|---|---|

| Adam and Olive Clark Memorial Fund | 15,742 |

| Anonymous | 188,522 |

| Art and Barb Worth Fund | 5,838 |

| Barbara and Ronald Bayne Fund | 3,206 |

| Cygnus Fund | 1,812 |

| Douglas J. Clark Fund* | 6,191 |

| Eva Rothwell Resource Centre Fund | 4,424 |

| Frank Charles Miller Fund* | 85,237 |

| James P. & Mary S. Phin Charitable Fund | 10,098 |

| Joe, Filomena and George Seliga Holdings Fund | 109,753 |

| Phenix Fund for Animal Welfare | 5,670 |

| Samaritans' Tithe Fund | 13,277 |

| Stoney Creek Health Fund | 37,860 |

| United Nations Culture of Peace Hamilton Fund | 1,265 |

| United Way Fund/Kenneth R. Walsh | 11,201 |

| Walter & Mildred Danby Fund* | 22,739 |

| TOTAL | 522,835 |

| Grants from scholarships and bursary funds | Amount |

|---|---|

| Albert & Betty Walters Fund | 400 |

| Amanda Marie Cowan Memorial Scholarship Fund | 1,284 |

| Bernie Morelli Memorial Bursary Fund | 1,339 |

| Charlie and Mabel Duncan Memorial Bursary Fund | 1,339 |

| Christina Hamilton Scholarship Fund | 4,232 |

| Cowan Family Fund | 2,416 |

| CPRS Hamilton Legacy Fund | 2,000 |

| Daniel Giannini Fund | 45,000 |

| Eugene B. Eastburn Fellowship Fund | 90,000 |

| General Bursary Fund/Genevieve A. Chaney & Cordelia C. Ensign | 34,666 |

| Geritol Follies Bursary Fund | 11,500 |

| Howard Fairclough Organ Scholarship Fund | 2,600 |

| James Darby Bursary Fund | 6,800 |

| Jeff Dickins Memorial Fund | 1,000 |

| Jervis B. Webb Company of Canada (Daifuku) Scholarship Fund | 27,500 |

| John E. VanDuzer Scholarship Fund | 2,000 |

| Mildred Dixon Holmes - Artist of the Year Fund | 2,000 |

| Music Bursary Fund | 1,934 |

| Ross F. Webb Bursary Fund | 3,267 |

| Rundle Foreign Study Bursary | 2,500 |

| Russell & Elizabeth Lindley Fund | 7,618 |

| William Allison Haynes Fund | 3,400 |

| TOTAL | 254,795 |

| Grants from donor-advised funds | Amount |

|---|---|

| Ambery Fund | 80,000 |

| Anonymous | 325,872 |

| ArcelorMittal Dofasco Children and Youth Fund | 11,609 |

| Bisaro Family Fund* | 2,843 |

| Chedoke Health Foundation Fund | 150,840 |

| Clark Family Foundation Fund | 53,000 |

| Cooke Family Fund* | 1,027 |

| David Davis Memorial Fund | 1,000 |

| Dr. Bob & Mildred Kemp Palliative Care Education Fund | 5,000 |

| Ed Smee Conserver Society Environmental Fund | 6,429 |

| Edith H. Turner Foundation Fund | 509,314 |

| Elham & Joseph Farah Family Foundation Fund* | 8,185 |

| Ella Baird & Grace Baird McQueen Memorial Fund/A.J. McQueen | 2,261 |

| Ellen Creaghan Fund | 30,000 |

| Fengate Community Foundation Fund* | 27,068 |

| Fengate Recreation Fund | 22,725 |

| The Gilmour Fund | 20,000 |

| Glen & Debra Swire Fund | 3,030 |

| Great Lakes Trust Fund* | 981 |

| Green Shield Canada Community Granting Fund | 2,270,000 |

| Hamilton Spectator Summer Camp Fund | 60,930 |

| Heather & Ross Hamlin Fund* | 593,267 |

| Heels Family Vocal Award Fund* | 13,029 |

| Hogarth Family Foundation Fund | 303,000 |

| Hugh C. Arrell Memorial Fund | 3,500 |

| Hundred Waters Foundation Fund* | 1,552 |

| Hutton Family Fund* | 103,334 |

| John & Esther Marshall Memorial Fund | 11,901 |

| John & Mary Reesor Fund | 7,710 |

| Kathleen C. Nolan Education Fund | 1,940 |

| Kirkpatrick Fund | 3,500 |

| Lawyers' Legacy for Children the Ray Harris Fund | 15,131 |

| Lee Hepner Award Fund | 1,800 |

| Lois Evans Natural Heritage Fund | 7,500 |

| Losani Family Foundation Fund | 95,000 |

| The Malloch Foundation Fund | 30,000 |

| Maple Leaf Centre for Action on Food Security Fund | 73,875 |

| Mark & Barbara Nimigan Fund | 4,000 |

| Marlies & Alan Clark Fund | 81,000 |

| The Martin Foundation Fund | 77,825 |

| Mayberry Family Fund* | 10,683 |

| McCallum, McBride Fund | 54,900 |

| Meredith Family Fund | 2,600 |

| Michael Chamberlain Fund | 60,000 |

| Mildred Dixon Holmes - Youth Orchestra Fund | 5,640 |

| The Milne McGrath Fund | 43,064 |

| Ray Brillinger & Cy Hack Fund | 6,000 |

| The Ron & Gina Fraser Endowment Fund | 5,489 |

| Rotary Club of Hamilton East-Wentworth Foundation Fund | 5,000 |

| Shirley M. Elford Artist's Fund | 2,600 |

| Sons of Italy Hamilton Trieste Lodge Legacy Fund | 1,000 |

| Tara Lynn Giuliani Foundation | 14,600 |

| Ted & Karin Bossence Fund* | 49 |

| Thorne Family Fund | 5,250 |

| Tran Family Fund* | 3,298 |

| W. L. Carpenter Memorial Fund* | 100,436 |

| Williams Family Fund* | 3,658 |

| The Young Fund* | 1,755,335 |

| TOTAL | 7,100,580 |

| Grants from field-of-interest funds | Amount |

|---|---|

| #HamOntForever Fund | 2,000 |

| Alfred & Joan Robertshaw Memorial Fund | 24,958 |

| The Alice Jean Ainsworth Memorial Fund | 84,551 |

| The Angel Fund* | 6,311 |

| Anonymous | 3,370 |

| Antonina Lombardo Fund | 7,508 |

| Arthur & Helena Lemon Fund | 5,342 |

| Barbara & Bob Harwood Fund | 9,479 |

| Barbara Bethune Fund* | 6,632 |

| Barbara Farnan Fund | 5,000 |

| Betty & Jack George Family Fund | 1,438 |

| Bill & Tina Seale Fund | 16,014 |

| Charles & Ret Swire Fund | 10,553 |

| Delaware Fund | 21,563 |

| Dougher Community Fund | 129,730 |

| Edward & Gladys Halloran Memorial Fund | 40,411 |

| Everard Hambro Fund | 2,282 |

| First Place, Hamilton Tomorrow Fund | 13,008 |